Pivot Indicator, Precision Pivot Master

Traders are able to discover reversal points and determine where optimal trades should be placed with the assistance of the Pivot Indicator for MT5.

- Description

- Indicator Settings

Description

All technical traders should be aware of the basic levels of forex support and resistance. Despite their importance, many technical traders—especially novices—find it challenging to position these levels.The Pivot indicator is used to tackle the issue of accurately placing important support and resistance levels.

The Foundation

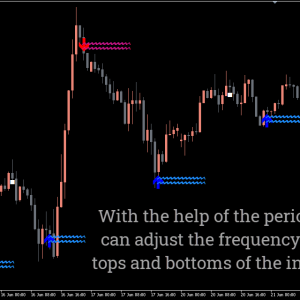

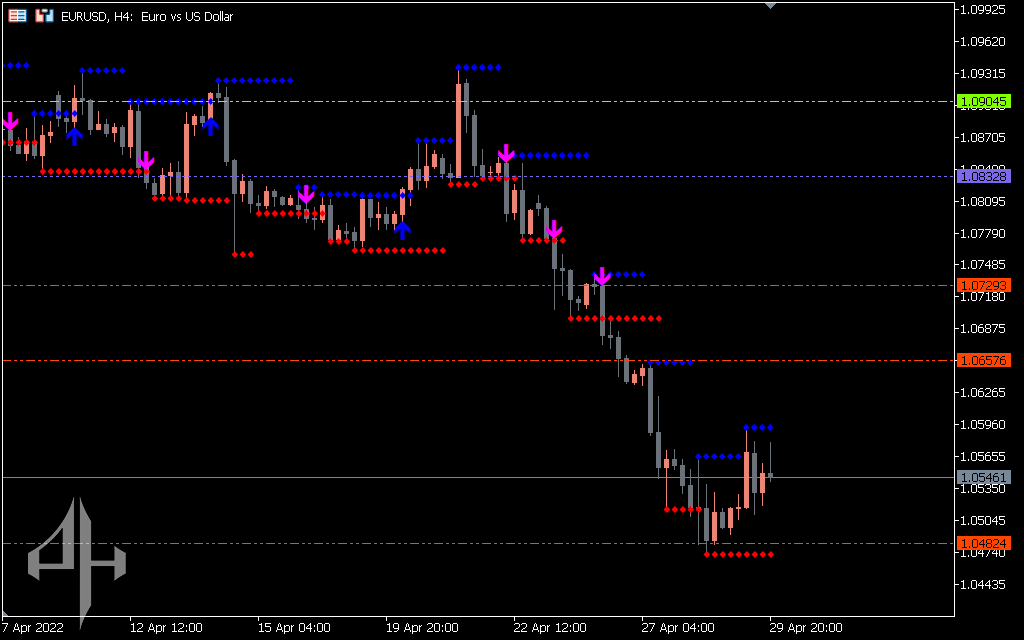

The MT5 Pivot indicator displays the potential price reversal levels. The chart has seven horizontal levels that represent possible support and resistance points where the price may move.

The diagram that follows shows the levels.

According to the above graphic, the first, second, and third resistance levels are denoted by the letters R1, R2, and R3, respectively.

The first, second, and third support levels are denoted by the S1, S2, and S3, correspondingly.

The pivot point line is the PP (yellow horizontal line), which is visible between the support and resistance zones.

Between the pivot point and the zones of support and resistance, the Pivot Indicator additionally plots midpoints or intermediate levels.

The open, low, high, and close of the previous trading session are used to calculate the pivot indicator.

The Pivot Point (PP) = (close + high + low)/3.

Other support and resistance levels are calculated from the Pivot Point.

First Resistance (R1) = (2 X PP) – Low.

Second Resistance (R2) = PP + (High – Low).

Third Resistance (R3) = High + 2 (PP – Low).

First Support (S1) = (2 X PP) – High.

Second Support (S2) = PP – (High – Low).

Third Support (S3) = Low – 2 (High – PP).

The ability of the Pivot Indicator for MT5 to assist technical traders in identifying possible support and resistance zones is one of its advantages.

Additionally, this indication is objective because all traders calculate it using the same formula, in contrast to the majority of subjective technical indicators.

For day traders or short-term traders looking to profit from slight price fluctuations, this indicator is quite helpful.

This indicator is frequently used by market makers and forex specialists to spot possible turning points.

How to use the Pivot Indicator

Both breakout and range traders can utilize the Pivot Indicator for MT5.

This indicator can be used by range traders to identify reversal levels and execute buy or sell orders.

In essence, S1, S2, and S3 are possible buy levels and R1, R2, and R3 are possible sell levels, much like trading support and resistance levels.

Before making a deal, breakout traders can also utilize this to determine which key zones to break.

A bullish market and strong purchasing momentum are indicated by a breach of R1, R2, and/or R3. After these levels break down in this situation, a buy order can be placed.

Consequently, a breach of S1, S2, and/or S3 indicates that the market is extremely bearish and that selling pressure is significant. If any of these levels are broken, a sell order may be issued.

Pivot can be utilized as take profit and stop loss levels in addition to buy and sell orders. For optimal results, this indicator should be utilized in conjunction with candlestick patterns.

Conclusion

The MT5 Pivot Indicator assists traders in determining pivot points and locations for profitable trade placements. When trading, it can also be used to calculate take-profit and stop-loss levels.

Additionally, we advise combining it with other indicators like the MACD, RSI, etc.

There are no adjustable parameters for the Pivot Indicator.