ADR Indicator, Unlock Market Volatility

MT4 ADR Indicator predicts market range as support and resistance. Best breakout and reversal forex strategy.

- Description

- Reviews (0)

- Indicator Settings

Description

The ADR-range and the current day’s market range are shown by the MT4 ADR Indicator. Thus, a projected market range for the day is provided by the ADR. Additionally, a shift in the momentum and trade volume close to the upper or lower ADR-level signals the start of a trend or a reversal. ADR Indicator values are a component of numerous auto trading techniques and serve as the foundation for numerous other forex technical indicators.

The indicator works best for both novice and seasoned forex traders. New traders can look for price action centered on the ADR-levels, which they can recognize as support and resistance. The indicator can be used in different trading systems, though, by skilled traders. The indicator is very simple to install and available for free download.

An ADR Indicator for MT4 Trading Configuration

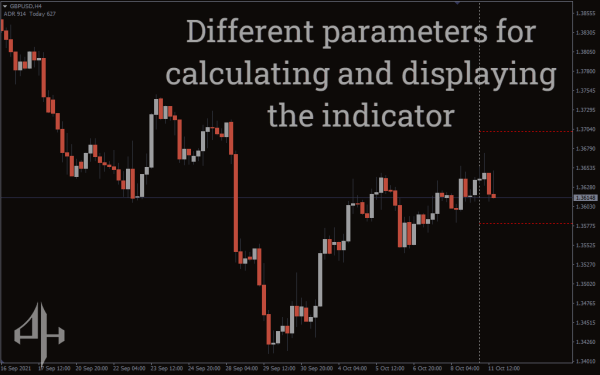

The EURUSD H1 chart above displays the MT4 indicator in operation. In the upper left corner of the chart, the indicator shows the ADR Indicator values as well as the range for the current day. Furthermore, the indicator displays a dotted line extending to the current trading day that represents the upper and lower ranges of the Average Daily Range.

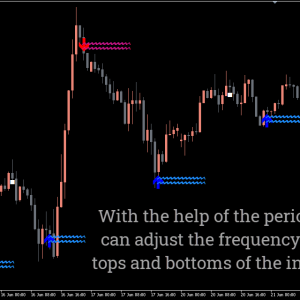

The Average True Range MetaTrader (ATR) indication is used to determine the values of the Average Daily Range MetaTrader indicator. Therefore, the time frame used to calculate the Average Daily Range is crucial in determining the range. The ADR-values of lesser historical data may be the consequence of a decreased ATR value. In a similar vein, a greater value computes the ADR-values using more data. In order to adjust to their trading strategy, technical forex traders should carefully select the ATR input in the indicator parameters. Forex traders should, however, experiment and adjust ATR levels appropriately because each currency pair has its own volatility.

Forex traders can trade utilizing the Average Daily Range by employing both breakout and reversal trading strategies. The forex trader can comprehend price extremes because the ADR gives a predicted market range. Therefore, with a stop loss below the previous swing low, forex traders can BUY when the price hits the lower ADR-level. The upper ADR level is the optimal take-profit for this position.

Similar to this, forex traders can identify reversal signals and SELL when the price hits the Upper ADR-line.

The ADR Indicator levels serve as intraday support and resistance levels and provide comparable outcomes in the intraday charts. Therefore, the best indicator for a trader to determine if a market is in a reversal or a breakout is price movement near the upper or lower ADR levels.

Conclusion

The ADR indicator for MT4 should be used by forex traders in conjunction with price action or other technical indicators. The most successful trading methods are the reversal and breakout strategies of the Average Daily Range. Forex traders can also easily download and install the indicator.

Be the first to review “ADR Indicator, Unlock Market Volatility” Cancel reply

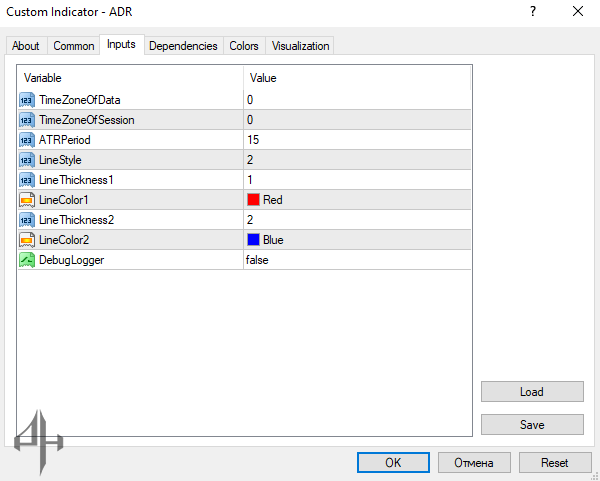

TimeZoneOfDate: Sets the broker’s time zone to align with the correct GMT offset.

TimeZoneOfSession: Configures the time zone for a specific trading session.

ATRPeriod: Defines the period length used in the Average True Range (ATR) calculation.

LineStyle: Specifies the style (e.g., solid, dashed) of the displayed line.

LineThickness1: Sets the width of the first line.

LineColor1: Selects the color for the first line.

LineThickness2: Sets the width of the second line.

LineColor2: Selects the color for the second line.

DebugLogger: Enables logging for developers working on automated Forex trading strategies.

Reviews

There are no reviews yet.