QQE Indicator, Unlock Explosive Trade Signals

The QQE Indicator is an extremely precise MetaTrader 4 indicator that offers irrefutable entry and exit locations for trades.

- Description

- Reviews (0)

- Indicator Settings

Description

The acronym for Qualitative Quantitative Estimation is QQE Indicator. The indicator’s foundation is RSI that has been smoothed out. In contrast to other indicators, Qqe has endured over time in terms of volatility fluctuations, particularly during the well-known global financial crisis of 2008. Even better, it rarely generates false signals and has no lag.

Using the QQE Indicator for Trend Trading

The trend is ascertained using the indicator. An upward or bullish market trend is indicated if the indicator is rising over the ten levels. As a result, you ought to hunt to get. By placing a long position when the indicator is above the 10-value level and a short position for lower values, you can utilize the indicator as a trade filter.

Positions that are overbought and oversold

The indicator can be used to determine when the price is in overbought and oversold conditions. Therefore, a strong market that is ideal for a long position is indicated when the indicator crosses the 12+ levels. In the same way, if the indicator moves toward negative values, you might enter a short position.

Difference using the QQE Indicator

Price and momentum divergence can be identified with the aid of the QQE indicator. When the Qqe indicator makes higher lows but the prices make lower lows, for example, this is known as a bullish divergence. This indicates a bullish reversal is about to occur.

On the other hand, a bearish divergence happens when the prices set higher highs, suggesting a possible positive turnaround, while the QQE is farming lower highs.

Additionally, a change in momentum is indicated when the bold line crosses the trailing line. Bullish momentum is seen when the bold line crosses above the slow trailing line. Similarly, short-term downward momentum is indicated when the smooth line crosses below the trailing line.

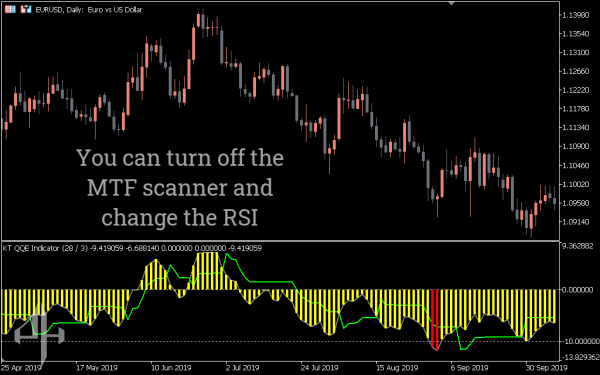

An Example of Trading

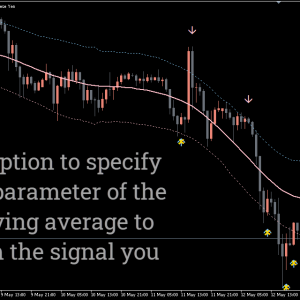

The accompanying image displays the daily price movement of the euro relative to the dollar. The price movement is clearly depicted by the gray line (smoothed RSI). The gray line climbs with very little delay while the price is rising. It also corresponds with a decline in pricing. After the price reaches the overbought and oversold regions, observe how it reverses.

When the gray line crosses below the lagging green line, as indicated by the green arrows, the indicator gives a sell signal. Likewise, when the price begins to increase, the gray line crosses the green line. As soon as the lines cross, there is a significant trend in the price.

Conclusion

Among the most accurate indicators is the QQE indicator. It provides a variety of buy and sell signal techniques. In essence, it can assist with trend reversal detection and trade entry at the best times. The indicator is something you should incorporate into your plan.

Be the first to review “QQE Indicator, Unlock Explosive Trade Signals” Cancel reply

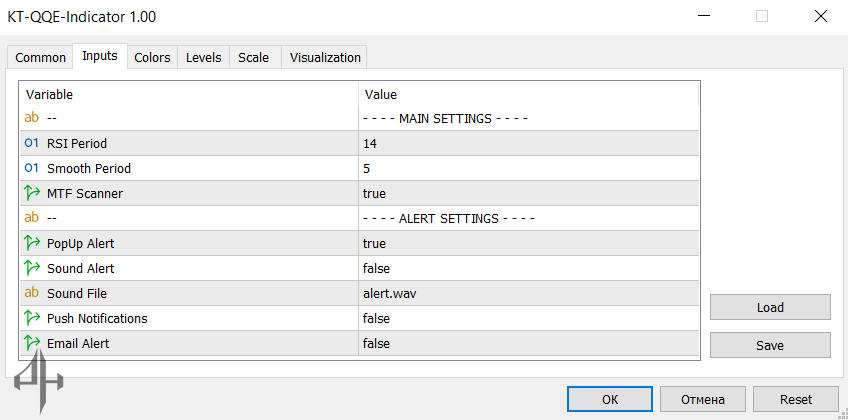

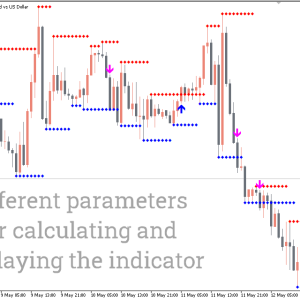

Main Settings

-

RSI Period: Defines the number of periods used to calculate the Relative Strength Index (RSI).

-

Smoothing Period: Specifies the smoothing factor applied to the RSI. A default value of 5 is used to reduce noise—lower values may produce more false signals.

-

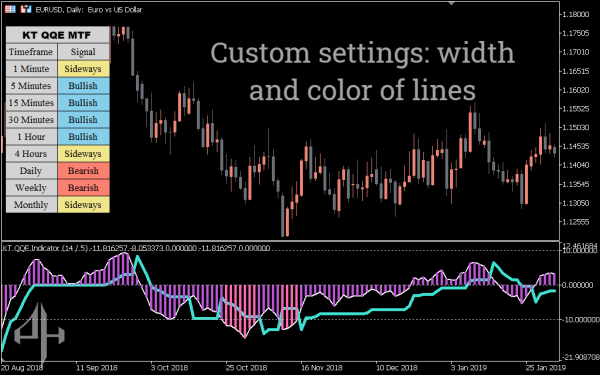

MTF Scanner: Enables multi-timeframe scanning, allowing the indicator to monitor RSI signals across all timeframes.

Alert Settings

-

Pop-Up Alert: Enables pop-up notifications when a signal is triggered.

-

Sound Alert: Turns on audible alerts for signals.

-

Sound File: Selects the audio file to be played for sound alerts.

-

Push Notifications: Enables or disables push notifications to mobile devices.

-

Email Alert: Turns email notifications on or off.

Reviews

There are no reviews yet.