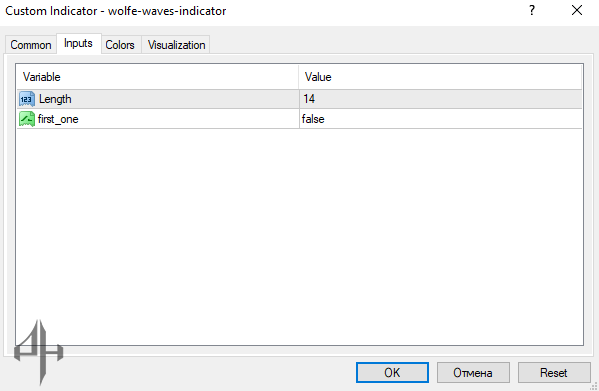

Length: The time period used to calculate the indicator.

First one: When enabled, the indicator shows one or more Wolfe Waves. Setting it to true will display only the most recent wave.

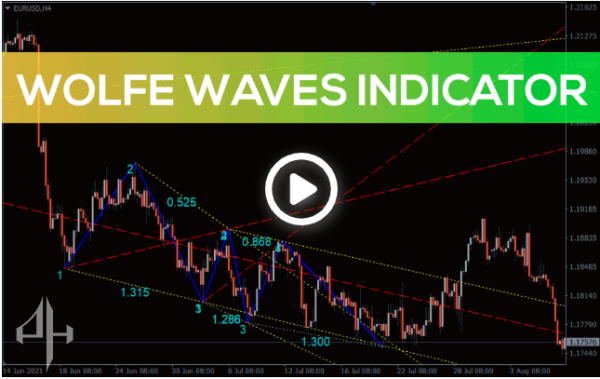

ideal detector for trend reversal. An excellent tool for determining precise buy and sell signals is the Wolfe Waves indicator.

Elliot is likely familiar to you, but the Wolfe wave is less so. Wolfe Waves Indicator are improved Elliot waves, or, if you prefer, Elliot waves on steroids. This natural trading pattern aids in identifying upcoming trends, forecasting future price movement, and estimating the time it will take to reach a particular target price.

A pricing pattern needs to fulfil a number of requirements in order to be classified as a Wolfe Waves Indicator.

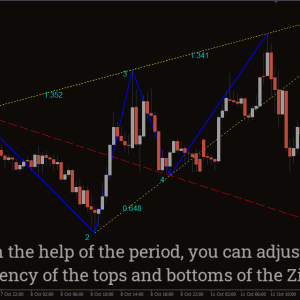

This wave is tedious to draw. In the worst situations, you run the risk of incorrectly drawing the wave, which could result in incorrect positioning and eventual loss. The Wolfe indicator is useful in this situation. The Wolfe indicator finds the Wolfe pattern by scanning the price chart.

Both the short-term and long-term trading indicators are applicable to any currency pair across time periods ranging from one minute to one month. It is appropriate for both novice and seasoned traders, as well as scalpers and longer-term investors.

Using the Wolfe Waves Indicator is simple. However, it takes a lot of patience. The formation of the fourth wave indicates an imminent price reversal.

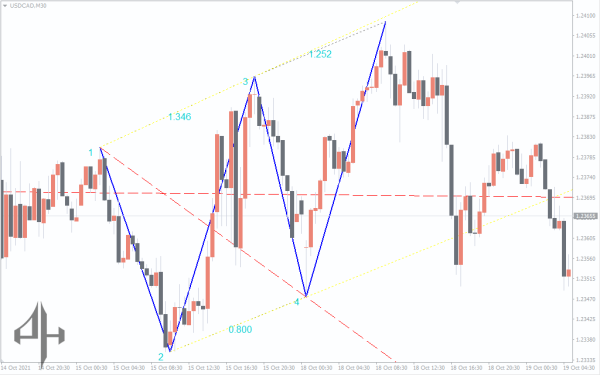

Await the first, second, third, and fourth waves to be drawn by the indicator. Proceed to trade in the fifth wave’s direction. For instance, the fifth wave would be in a downtrend if the fourth wave was in an upward trend. Consequently, you ought to try to get into a bearish position. Likewise, you should try to get into a bullish position if the fourth wave is negative.

For an uptrend, place the stop loss below the most recent swing low; for a downtrend, place it below the swing high. The take-profit point need to be at the channel’s trend line, which was established by the earlier waves.

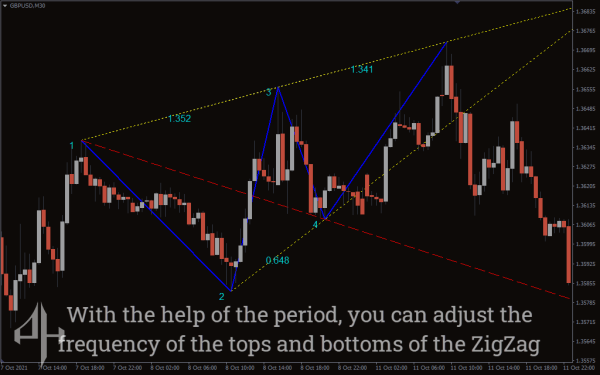

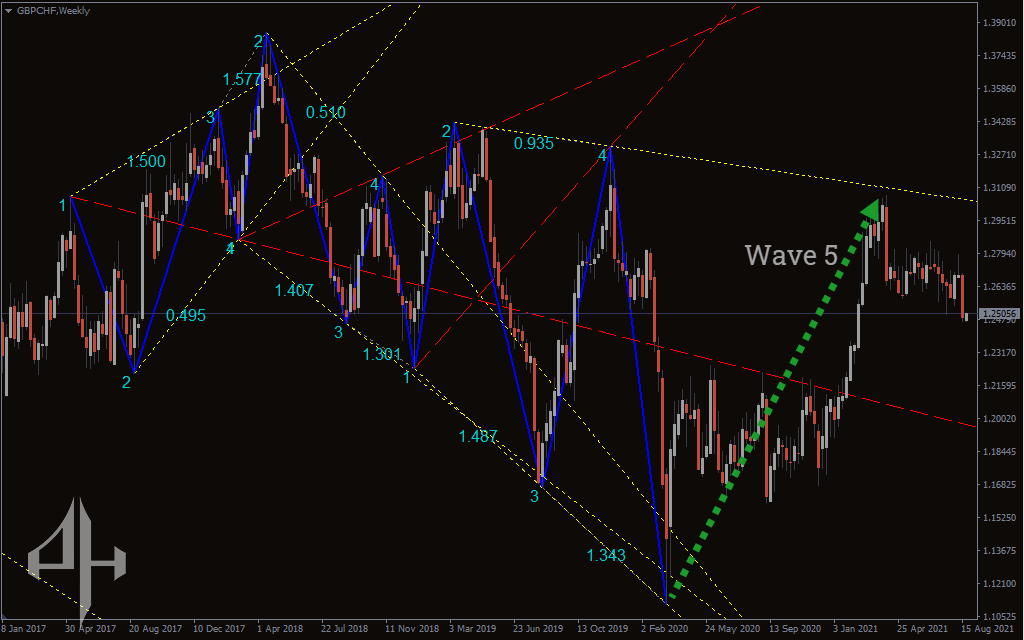

The graph displays the weekly price movement of the British pound relative to the Swiss franc. After scanning the price, the indicator shows a bluish Wolfe wave. Take note of how the channel formed by the first and second waves gives rise to the third and fourth waves. Traders should be prepared to enter the trade as soon as the fourth wave touches the channel trend line.

The green indicator in this instance indicated that it was time to enter a purchase position. Observe how the price moves in tandem with the fifth wave until it reaches the channel line established by the preceding waves. The Wolfe Waves indicator was exactly followed by the price.

The fourth wave was bearish in this instance. The fifth wave is bullish as a result. You should leave the trade and watch for a new pattern whenever the price crosses this trend line.

Accurate trading entry signals are provided by Wolfe Waves Indicator. Drawing the indication is not an easy task, though. The indicator makes your task easier. The Wolfe Waves indication is an easy-to-use and uncomplicated indicator. By scanning the chart and displaying the wave, it helps you identify precise buy and sell signals. It is not necessary to confirm with further signs. This indication can be used as a standalone indicator.

Length: The time period used to calculate the indicator.

First one: When enabled, the indicator shows one or more Wolfe Waves. Setting it to true will display only the most recent wave.