Breakout Zones Indicator, Precision Trading Like Never Before

The MT4 breakout zones indicator uses the breakout zones’ support and resistance to produce forex BUY and SELL trading signals. Installing it is simple and free.

- Description

- Reviews (0)

- Indicator Settings

Description

Based on the price movement, the breakout zones indicator for MT4 automatically displays resistance and support lines on the price chart. When the price breaks above the support line, it is deemed bullish. A bearish market is also indicated by a price movement below the support line. Forex traders can therefore use the support and resistance to manage their current transactions or buy and sell in response to bullish and bearish market fluctuations.

Both novice and experienced forex traders can benefit from the indicator. Well in advance, novice traders are able to recognize market trends, formulate trading plans, and predict possible daytime price movements. If there is a price breakout of the zone, experienced forex traders can create intricate trading plans.

To determine the day’s breakout zone, forex traders can position the indicator on any intraday price chart. Traders can also easily install the indicator after downloading it for free.

Breakout Zones Indicator For MT4 Trading Signals

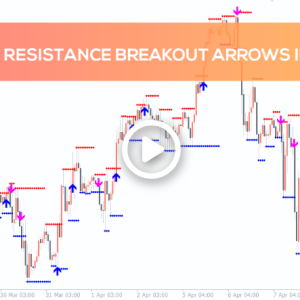

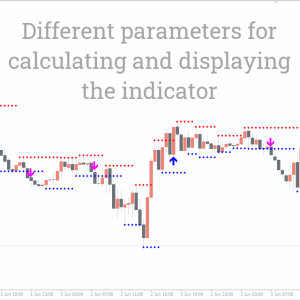

The breakout zones indicator for MT4 is displayed in action in the GBPUSD M30 candlestick price chart above. The support and resistance lines are indicated in red by the indicator. To trade the breakout zone successfully, technical forex traders need follow the support and resistance breakout trading guidelines.

A possible bullish trend is indicated if the price breaks the resistance line and rises above the breakout zone. Therefore, forex traders should put a stop loss below the last swing low and enter the markets with a BUY position.

Forex traders should employ other techniques to determine the optimal aim because the indicator does not indicate a possible profit target. In the long term, a take-profit greater than the 1:2 risk-reward ratio will yield favorable outcomes.

In a similar vein, the price will fall lower if it breaks the support and travels more slowly than the breakout zone, effectively breaking the breakout zone. Traders might use a stop loss above the previous swing high to initiate a SELL trade.

If the trader confirms the breakout after the candle closes, trading a breakout will yield the best rewards. Further evidence of the breakout is provided by the candle closing above the resistance or below the support line. However, it could have unfavorable effects if forex traders enter the market too quickly during the breakout candle.

In conclusion, the trader’s ability to recognize and validate the breakout utilizing reliable technical procedures and price action largely determines the trading outcomes of the breakout zones indicator for MT4. Traders should also be aware that breakouts are typically accompanied by higher trading volumes.

Conclusion

For support and resistance trading, the MT4 breakout zones indicator is a crucial tool. To ascertain a possible market direction, forex traders look for a zone and watch for a breakout. But traders need to be ready for a lot of false breakouts. In order to verify the breakout, breakout traders should also employ other indicators such as trend lines and channels. The price action during the breakthrough, however, is the most crucial factor.

Be the first to review “Breakout Zones Indicator, Precision Trading Like Never Before” Cancel reply

-

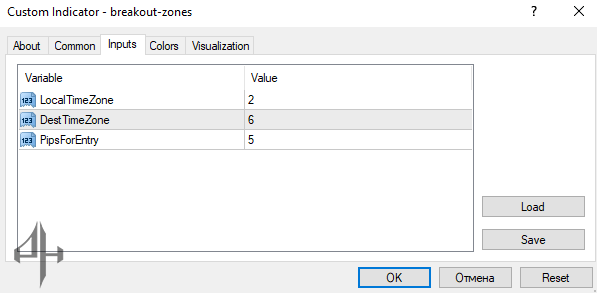

LocalTimeZone: The local time zone used by the trading terminal.

-

DestTimeZone: The broker’s time zone.

-

PipsForEntry: The number of pips used to define the entry point.

Reviews

There are no reviews yet.