FXSSI Sentiment Lite, Supercharge Your Forex Strategy

The Speculative Sentiment Index (SSI) is a free indicator that shows open positions. aids in comprehending the actions and goals of those involved in the forex market. based on the data pertaining to the proportion of positions held by buyers and sellers.

- Description

- Reviews (0)

- Indicator Settings

Description

The free FXSSI Sentiment Lite indicator shows the Speculative Sentiment Index (SSI) open positions. Understanding the mood of the market’s participants—buyers and sellers—is a crucial requirement for profitable forex trading. The behavior of traders in the market can be analyzed in a variety of ways. The best examples are the technical or fundamental analysis.

Regardless of the techniques you employ in your trading strategy, you will ultimately need to examine the open positions held by market players.

An indicator that shows the correlation between buyers and sellers in an easily comprehensible format is by default absent from the MT4 terminal.

One potential remedy for this issue is the FXSSI Sentiment Lite indicator, which is available for free.

Features and explanation of the FXSSI Sentiment Lite Indicator

In the MT4 terminal graphic, the FXSSI Sentiment Lite indicator shows the percentage ratio of buyers to sellers. The information will be shown on the chart as a scale once it is active. This scale displays the current open positions held by participants in the forex market.

Buyer sentiment is represented by the blue portion of the indicator scale, whereas seller sentiment is represented by the red portion. The advantage of open long positions over short ones is indicated if the blue portion of the scale is larger than the red.

The inverse is also true: there are more open sell positions if the red portion of the scale is larger.

Based on information supplied by the top brokerage firms, the open positions indicator displays the ratio of buyers to sellers. The IG Group broker, for instance, is one of its sources.

FXSSI Sentiment Lite indicator is automatically updated once every hour by default. If preferred, this time frame can be shortened to five minutes.

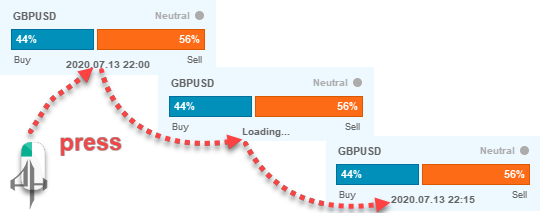

Additionally, the indicator enables manual data update through mouse button clicks.

To accomplish this, left-click the mouse and move the pointer over the time shown on the indicator.

After then, the time of the current indicator data will be updated together with the buyer-to-seller ratio.

Both scalpers and mid-term and intraday traders can use the indicator with success. The length of time you keep open positions and your objectives for them will determine this.

When trading on M1-M5 timeframes, you can “feel the pulse of the market” by keeping the indicator updated every five minutes. It will enable you to respond quickly to shifts in the buyer-to-seller ratio.

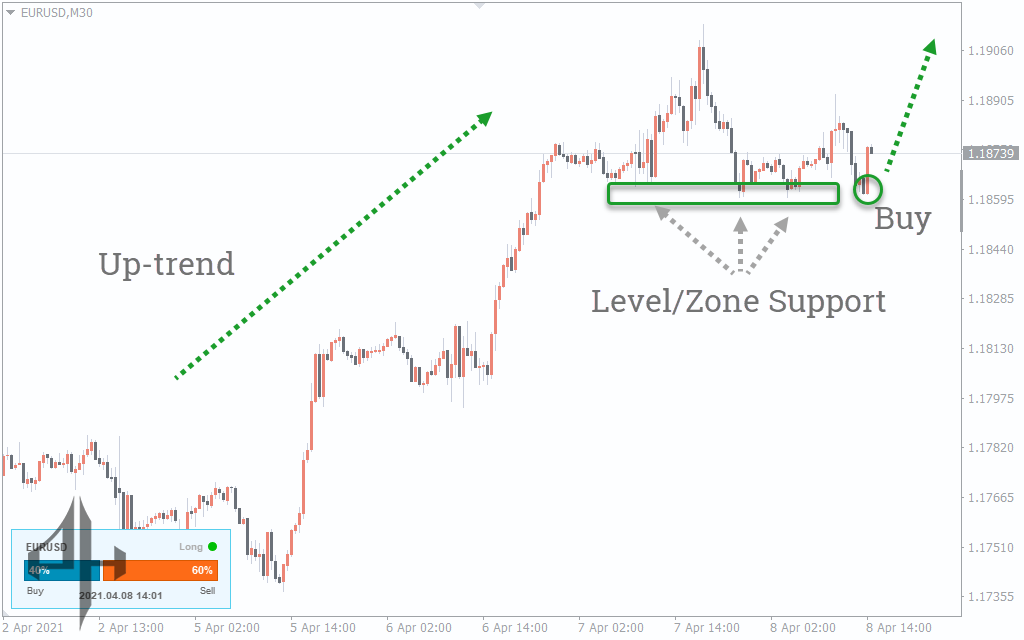

You can utilize the emotion FXSSI Sentiment Lite indicator in conjunction with support and resistance levels, for instance, if your trading strategy is geared toward intraday or midterm trading. It can assist you in identifying the market’s correction phase so that you can initiate trades when the primary trend resumes.

FXSSI Sentiment Lite indicator data should be refreshed for this purpose every 20 to 1 hour. It will assist you in monitoring the price movement in the vicinity of certain levels.

Utilizing the indicator as an extra component of a trading system

Economic news, the activity of the currency market around the clock, the range of participants from central banks to intraday traders, and other factors all have an ongoing impact on how the asset’s price is formed.

Understanding the percentage of open traders’ positions in the market improves the likelihood of a profitable trade in such a difficult environment.

By alone, the indicator is unable to produce precise trade signals. However, if you include it as an extra signal to your trading system, it can hint to possibly intriguing entry points.

The open positions indicator in the aforementioned example shows that there are more open sale trades than buy trades (62% to 38%, respectively).

However, the present downward trend within the upward trend is really a correction.

It’s possible that the trend movement will soon resume at the support level indicated by the rectangle on the chart. In a possible transaction, a stop loss ought to be positioned behind the support level.

Thus, in this case, the market sentiment indicator has been useful in determining the uptrend’s corrective phase as well as a possible prospective buy target.

FXSSI Sentiment Lite indicator won’t be very noticeable because it is small and has aesthetically pleasing color schemes. However, if needed, it will also be simple to locate in the MT4 terminal’s chart. Therefore, the market sentiment indicator can be helpful for both novice and experienced traders due to its easy-to-use presentation and efficiency.

Be the first to review “FXSSI Sentiment Lite, Supercharge Your Forex Strategy” Cancel reply

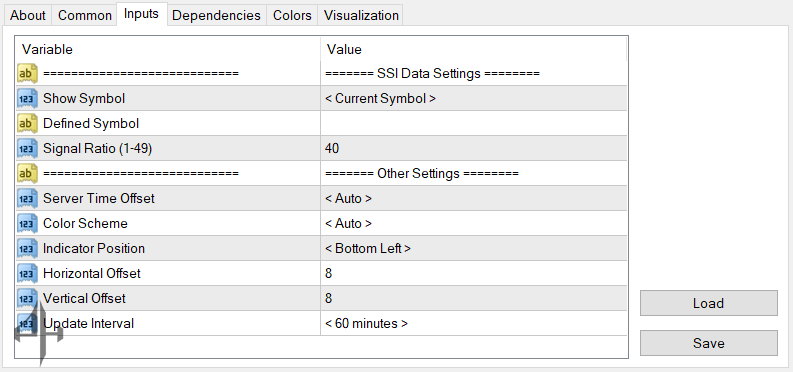

Show Symbol – enables you to select the data source for constructing the indicator. This can be either the currently active currency pair or a currency pair manually chosen from the Defined Symbol option.

Defined Symbol – allows you to specify manually the currency pair on which the indicator will be based. The format should follow standard currency pair notation, such as GBPUSD or EURUSD.

Signal Ratio – lets you define the percentage of open positions that will trigger buy or sell signals. For example, if set to 40% or lower, the indicator will generate a buy signal; if set to 60% or higher, it will generate a sell signal.

Server Time Offset – provides the option to select the desired time zone.

Color Scheme – enables choosing the color theme for the indicator.

Indicator Position – allows adjustment of the indicator’s placement on the chart.

Horizontal Offset / Vertical Offset – permits moving the indicator window horizontally or vertically on the chart.

Update Interval – sets how frequently the indicator refreshes or updates its data.

Reviews

There are no reviews yet.