ADR Indicator, Explosive Market Volatility Insights

The MT5 ADR indicator depicts the projected market range as support and resistance. Best breakout and reversal forex strategy.

- Description

- Indicator Settings

Description

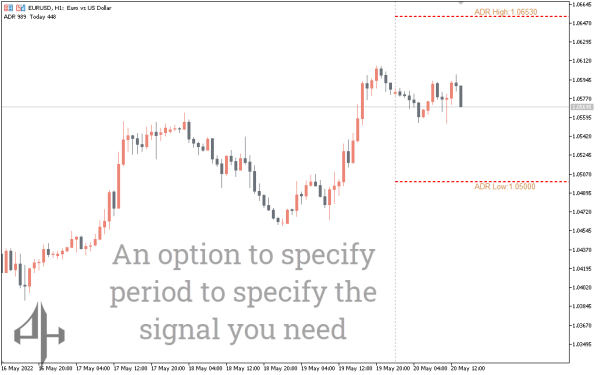

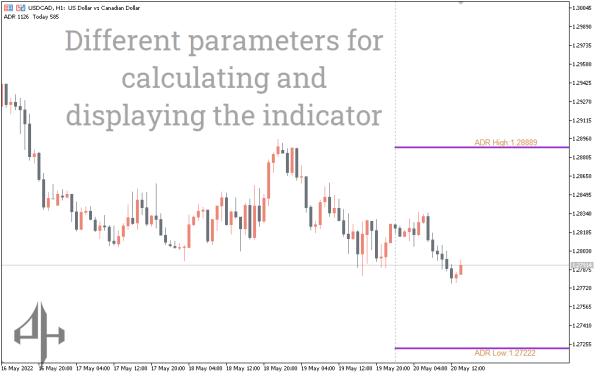

The ADR range and the current day’s market range are shown by the MT5 ADR indicator. As a result, ADR displays the anticipated market range for the day. Additionally, a shift in trading volume and momentum close to the ADR’s upper or lower level signals the start of a trend or reversal. Average Daily Range values are used in many automated trading methods and serve as the foundation for numerous other forex technical indicators.

The indicator works best for both novice and seasoned forex traders. ADR Indicator levels can be use as support and resistance, and novice traders can observe how the price fluctuates around them. The indication can be incorporate into other trading systems, though, by skill traders. The indicator is very simple to install and available for free download.

An ADR Indicator for MT5 Trading Setup

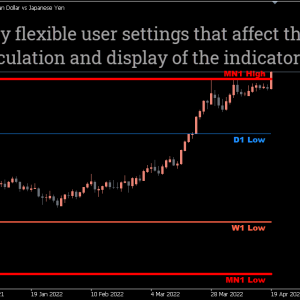

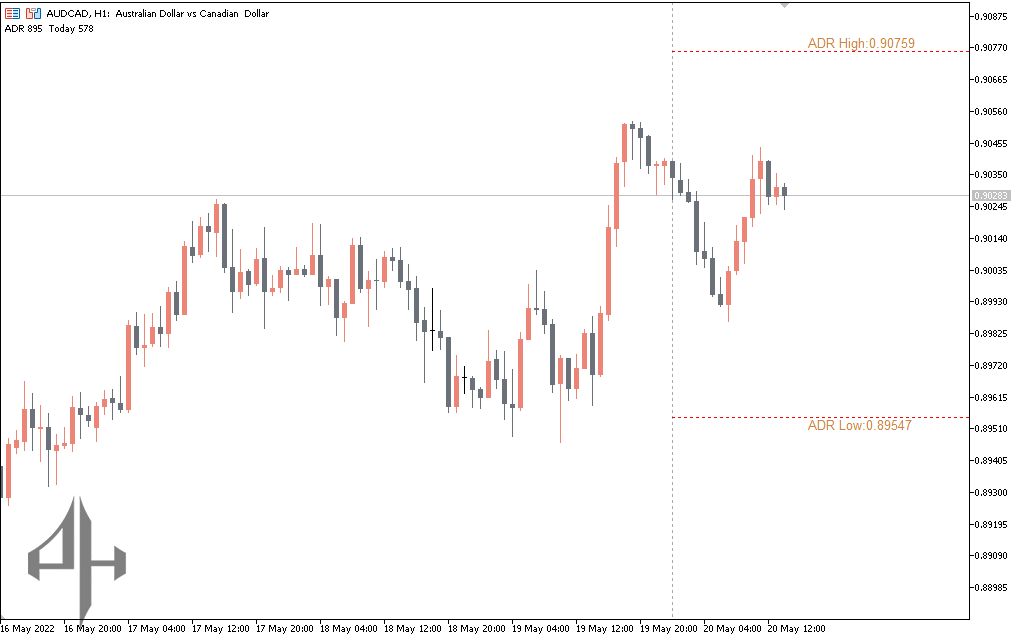

The MT5 indicator is show in action on the AUDCAD H1 chart above. In the upper left corner of the chart, the indicator shows the ADR Indicator values as well as the range for the current day. Furthermore, the indicator shows a dotted line that extends till the current trading day, representing the upper and lower range of the average daily range.

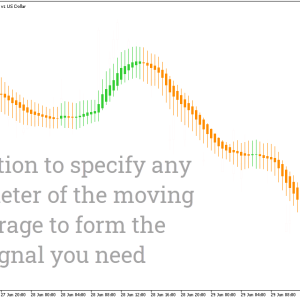

The ATR, or Average True Range MetaTrader, indication is use to determine the values of the Average Daily Range MetaTrader indicator. Therefore, a key factor in establishing the range is the average daily range calculation time. On historical data, smaller Average Daily Range readings could be the consequence of a lower ATR value. Likewise, a larger value computes ADR values using huge data. In order to adjust to their trading strategy, technical forex traders should carefully choose the ATR entry in the indicator parameters. However, forex traders should test and adjust ATR values based on the volatility of each currency pair.

Forex traders can trade utilizing the average daily range by employing the breakout and reversal trading strategies. A forex trader can comprehend price extremes since the ADR gives the predicted market range. With a stop loss below the prior swing low, forex traders can therefore BUY when the price reaches the ADR’s low. The high ADR level is the optimal take-profit for this investment.

Similar to this, forex traders can identify reversal signals and SELL as soon as the price reaches the upper ADR line.

On intraday charts, Average Daily Range levels function as intraday support and resistance levels and provide comparable outcomes. The strongest indicator of whether the ADR is a breakout or a reversal is therefore the price action surrounding its high or low level.

Conclusion

The ADR indicator for MT5 should be use by forex traders in conjunction with price action or other technical indicators. The best results are obtain using medium daily range breakout and reversal trading techniques. Additionally, the indicator is simple for forex traders to download and implement.

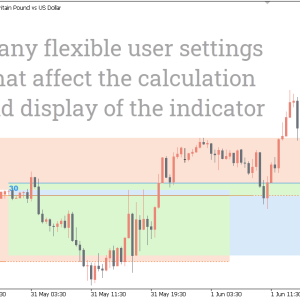

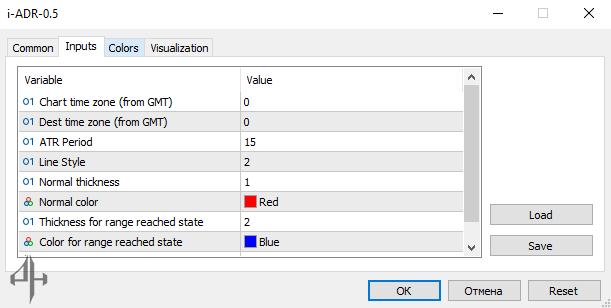

TimeZoneOfDate: Broker’s time zone setting used to adjust the GMT offset.

TimeZoneOfSession: Time zone configuration specific to a trading session.

ATRPeriod: Time period used to calculate the Average True Range (ATR) indicator.

LineStyle: Defines the style of the line.

LineThickness1: Thickness setting for line 1.

LineColor1: Color setting for line 1.

LineThickness2: Thickness setting for line 2.

LineColor2: Color setting for line 2.

DebugLogger: Tool intended for developers working on forex automated trading strategies.