Advanced Hedge MT4

Advanced Hedge MT4 EA uses a hedging strategy to handle trades. It has tools for managing risk and works with a wide range of asset classes, making it easy to trade automatically with high rewards.

- Version: 4.0

- Updated: 2 August 2021

- Description

Description

If you’re looking to take your trading to the next level, Advanced Hedge MT4 might be just what you need. Developed by Ho Tuan Thang, this Expert Advisor (EA) for MetaTrader 4 is built around a high-risk, high-reward hedging strategy. With its focus on managing trades through mathematical logic and its ability to trade across multiple asset classes, Advanced Hedge MT4 offers a comprehensive, hands-off trading experience.

Why Choose Advanced Hedge MT4?

1. Hedging Strategy for Trade Management

The core of Advanced Hedge MT4 is its innovative hedging approach. Instead of relying on traditional indicators, the EA uses a mathematical model to help manage positions. This allows it to recover from losses and capitalize on price movements in both trending and sideways markets. It’s a strategy designed to optimize your trade management in a more systematic way.

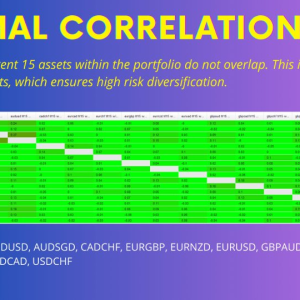

2. Advanced Hedge MT4 Multi-Asset Compatibility

This EA isn’t limited to just one asset class. It works across a variety of markets, including:

-

Forex Pairs like EURUSD, GBPUSD

-

Commodities such as XAUUSD (Gold)

-

Cryptocurrencies like BTCUSD

This flexibility gives you the opportunity to diversify your trading portfolio and take advantage of more market opportunities.

3. Works with Any Broker

No matter what broker you use, It can work seamlessly with your setup. It’s designed to be versatile and adaptable to different trading environments, making it accessible to traders worldwide.

4. Advanced Hedge MT4 Risk Management Features

While It is a high-risk, high-reward strategy, it comes with risk management features to help you trade more responsibly. The system advises using a fixed lot size of 0.01, regardless of your account balance, to ensure consistent risk exposure across trades.

5. Thorough Backtesting

Before hitting the live market, the Advanced Hedge MT4 EA has undergone extensive backtesting, including tests using real tick data from Dukascopy between 2016 and 2021. This ensures that the EA has been thoroughly evaluated and optimized for different market conditions, providing you with greater confidence in its performance.

Conclusion

If you’re looking for a hands-off, automated trading system that can adapt to different market conditions, It could be the perfect fit for your trading strategy. Its unique hedging approach, multi-asset compatibility, and solid backtesting make it a powerful tool for both new and experienced traders alike. Whether you’re trading forex, commodities, or cryptocurrencies, this EA offers flexibility and risk management to help you make more informed decisions.