CPR Indicator, Unlock Consistent Profits

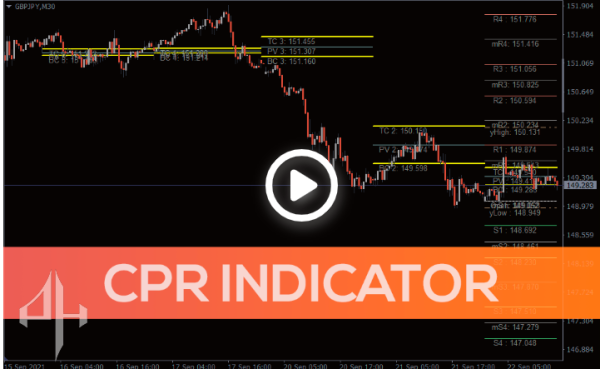

The finest MT4 price-level analysis indicator for forex and stocks is CPR Indicator (Central Pivot Range). MTF charts suit breakout and trend trading.

- Description

- Reviews (0)

- Indicator Settings

Description

An advanced pivot indicator that offers technical support for daily price-level analysis is the Central Pivot Range, or CPR Indicator.

One of the most common strategies used by day traders of stocks and FX is the use of pivot points to identify short-term support and resistance levels. It highlights key market event regions where the price determines the course of its subsequent movement.

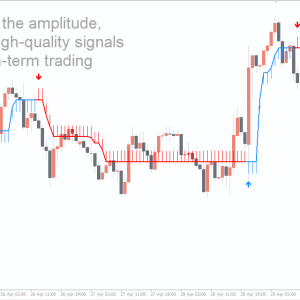

From a technical standpoint, CPR functions similarly to the original pivot points indication. However, it introduces a novel concept of using the chart’s top, bottom, and middle pivot points to determine the crucial price levels. A number of S/R lines based on daily, weekly, and monthly price movements are also displayed.

CPR, like the majority of pivot indicators, does not, however, produce clear buy/sell recommendations. It merely lists the possible locations where you could come across intriguing shifts in the supply and demand for an asset and turn them into trading opportunities. Therefore, you may be able to predict very likely trade signals at important price levels with a rudimentary comprehension of candlestick patterns.

How can you calculate the buy-sell levels using the CPR indicator

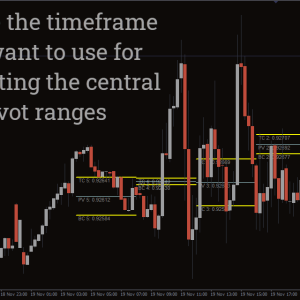

The three pivot levels that make up the CPR Indicator are the top central pivot (TC), bottom central pivot (BC), and center pivot (PV).

You can determine if the price is bullish or bearish by looking at the central pivot. For example, a bearish momentum is indicated when the price maintains its position below the central pivot level. At this stage, you could get ready for a potential future sale opportunity.

Based on the mood of the market right now, you can use both the TC and BC levels to assist you decide which way the price is moving. For instance, the asset is under tremendous purchase pressure and is probably going to head north if the price rises above TC. Therefore, in this case, placing a buy order could allow you to profit as much as possible from the current bullish trend.

Additionally, CPR Indicator plots a number of lines of support and resistance around the central pivot level, which you may use to predict stop-loss positions and profit objectives.

Conclusion

A straightforward method for maximizing the utilization of pivot points is the CPR Indicator. For technical traders, particularly novices who find it difficult to manually estimate the daily support/resistance levels, it is a useful tool. Pivot lines might not, however, provide sufficient assurance to carry out an order. Therefore, you may get the most out of employing pivot points in Metatrader 4 if you use extra tools like trendlines and moving averages in addition to CPR.

Be the first to review “CPR Indicator, Unlock Consistent Profits” Cancel reply

CPR Indicator Overview

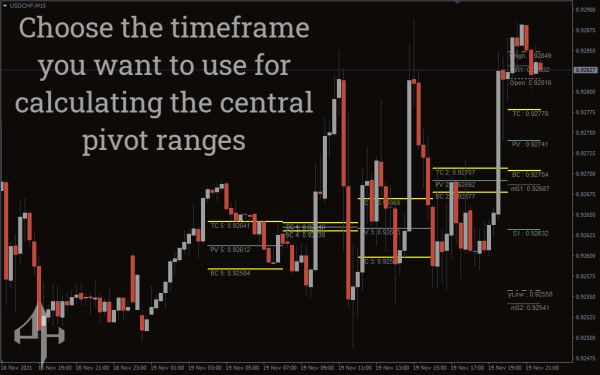

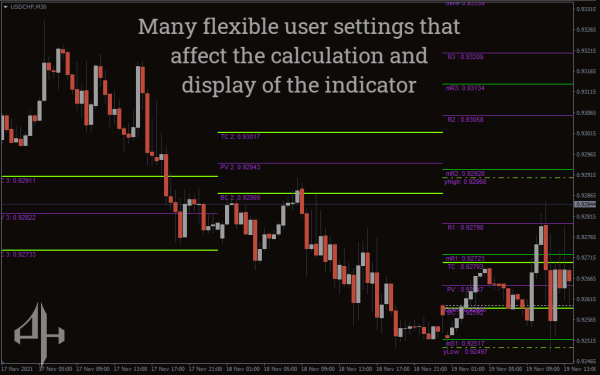

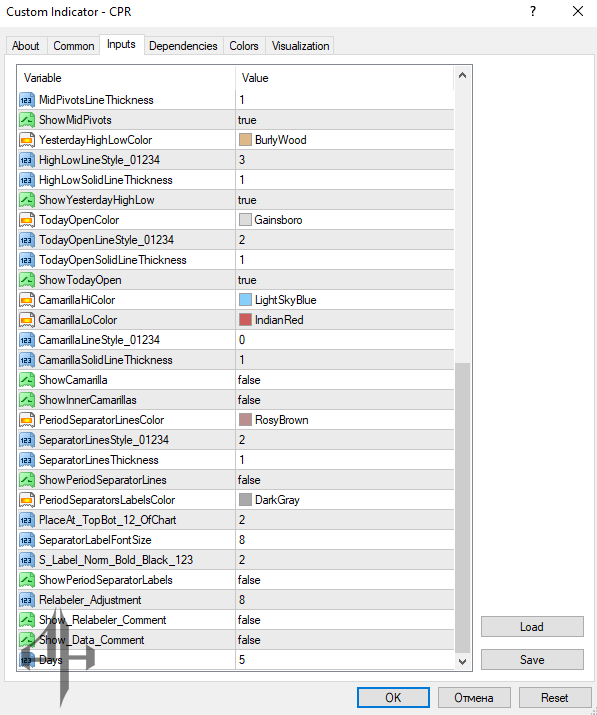

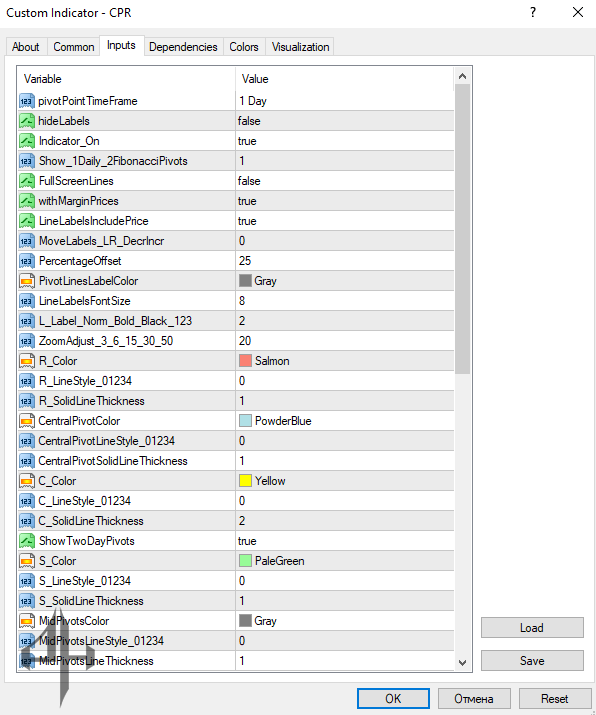

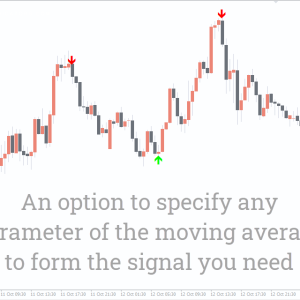

The CPR (Central Pivot Range) Indicator is fully customizable and offers a wide range of configuration options through its settings menu. Below are some of the key parameters to understand when applying it to MT4 platforms:

-

Pivot Point Timeframe: Select the desired timeframe for calculating the central pivot ranges (e.g., daily, weekly).

-

Hide Labels: When enabled, this feature reveals additional information for each pivot level.

-

Show_1Daily_2FibonacciPivots: Controls how many Fibonacci pivot levels are displayed on your MT4 chart.

-

With Margin Prices: Toggles the display of margin prices above and below the central pivot levels.

-

Line Labels Include Price: Set this to “true” to include price values next to each support and resistance label.

Reviews

There are no reviews yet.