Cumulative Delta Indicator, Powerful Cumulative Delta

Cumulative Delta Indicator is A fantastic indicator that may be used to show buy and sell indications. The perfect indicator of trends.

- Description

- Indicator Settings

Description

The Cumulative Delta Indicator is a great tool for displaying buy and sell signals. The ideal trend-spotting tool. The Forex market is influenced by various variables. However, generally speaking, the forces of supply and demand between buyers and sellers are what drive price changes. The price increases when there are more buyers than vendors. In a similar vein, the price drops when there are more sellers than buyers.

The level of aggression displayed by buyers and sellers determines the price momentum. In order to tabulate the number of buyers and sellers in the market, you must have sufficient data. It takes a lot of time to calculate the differences between buyers and sellers at each level, even given this data. Fortunately, you can get the Cumulative Delta Indicator for MT4 for free.

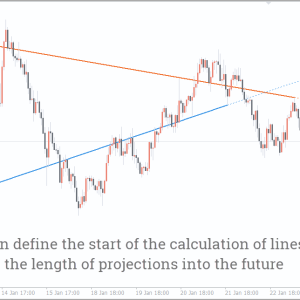

Delta is basically the differential between the suppliers and the purchasers. In a pane beneath the chart, the indicator shows the information as a bar after calculating the difference between the buyers and sellers. When market momentum is strong, the bar lengthens.

The Cumulative Delta Indicator is simple to understand and interpret. Therefore, regardless of your level of experience in the profession, you may use it with ease. The indicator may be used to trade any instrument, including forex currency pairings, and it performs well in all time frames, including daily, hourly, and 15-minute ones.

How to Use the Cumulative Delta Indicator to Trade

As previously stated, the Cumulative Delta Indicator subtracts the volume of buyers from the number of sellers to display the sum of the delta bars. The amount of bars that are included in the summing can be changed.

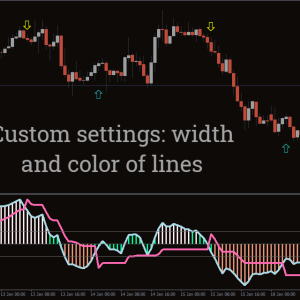

Buy Signal

When the indicator displays a green bar, it is a buy signal. This indicates that there are more customers than sellers in the market, which gives them the ability to raise prices. You should try to initiate a long position when the market is rising.

In a similar vein, when there are more sellers than buyers, the indicator signals a sell. Thus, you ought to think about initiating a short position. A massive bearish pressure is characterized by an elongated red bar.

Great Britain’s price fluctuation in relation to the US dollar is displayed on the price chart. The price is strongly declining, which indicates that sellers are driving the price lower. The price is declining, as indicated by the indicator’s enormous red bar. Thus, you ought to take a short position.

Conclusion

Whether buyers or sellers control the market is indicated by the Cumulative Delta Indicator. It determines the difference between buyers and sellers to obtain this information. This information will be useful to you as a trader when deciding whether to purchase or sell. Basically, you should buy when the market is bullish and sell when it is down trending. To create confluence and maximize favourable outcomes, it is wise to combine this indicator with other trading techniques and resources.

Show Cumulative – Allows displaying cumulative values within a selected time period.

Record Ticks – Enables or disables the recording of historical data.

Print History – Allows the indicator to generate history based on tick data. If set to false, the indicator will start calculations from zero.

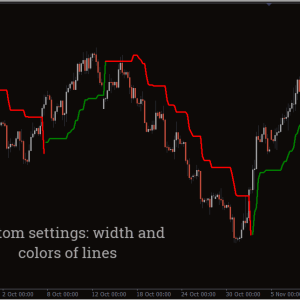

dnColor – Specifies the color used for downward ticks.

UpColor – Specifies the color used for upward ticks.

ShowCorr –

corrPeriod –