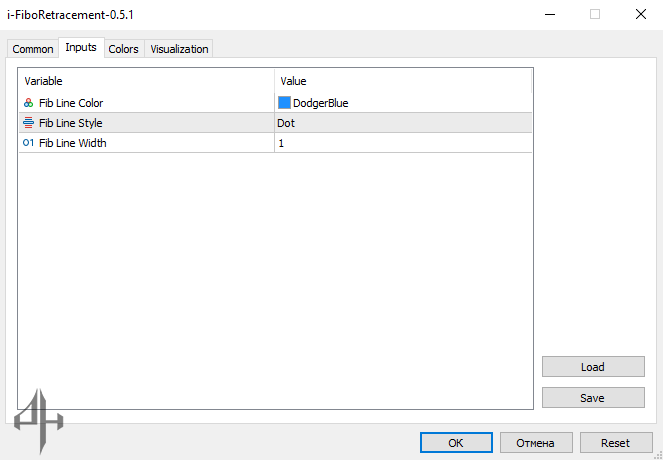

In the indicator settings, the following parameters can be adjusted:

-

Fib Line Color – lets you choose the color of the Fibonacci levels.

-

Fib Line Style – allows you to select the line type for displaying the Fibonacci levels.

-

Fib Line Width – enables you to adjust the thickness of the Fibonacci lines.