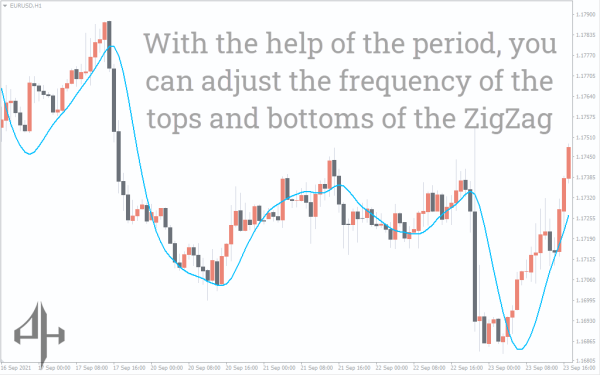

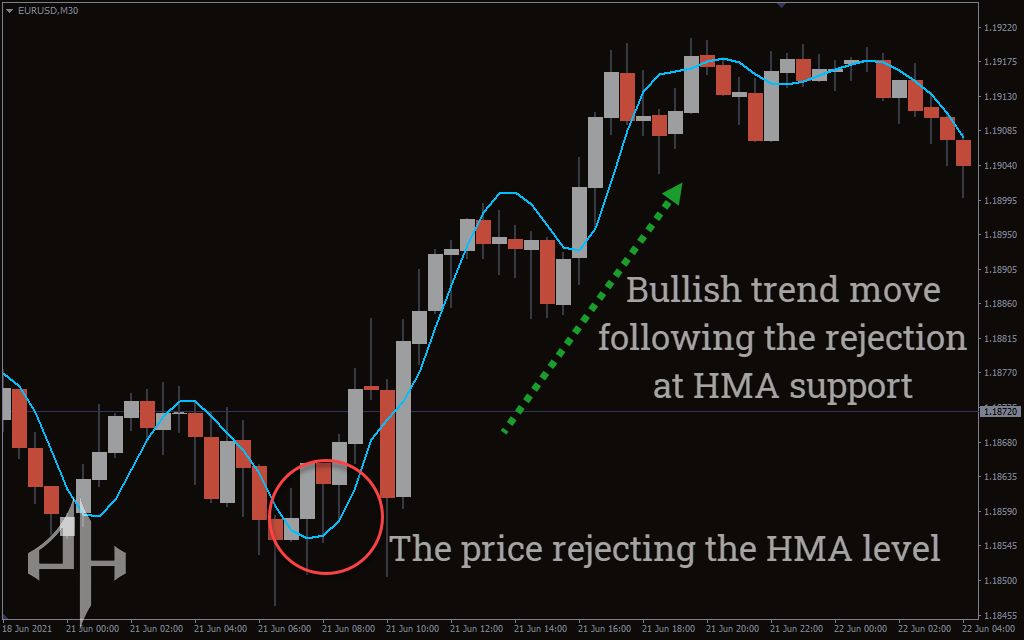

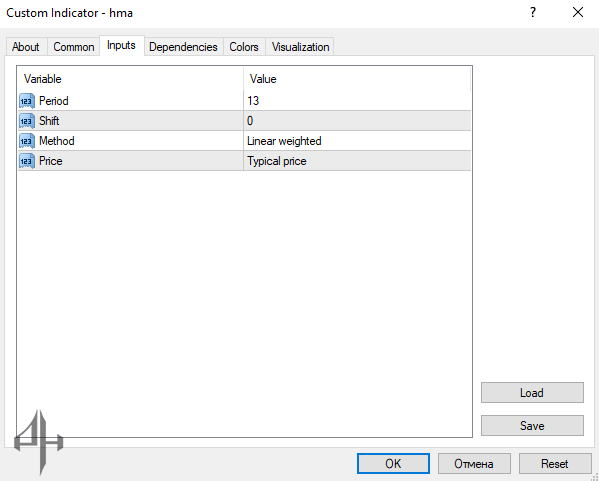

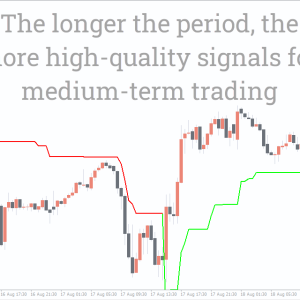

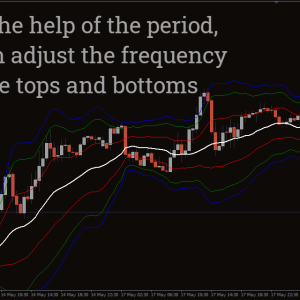

Period: Defines the number of candles the indicator uses to convert price data into a moving average.

Shift: Adjusts the indicator’s position relative to the price level by specifying the distance or offset.

Method: Selects the calculation technique for the moving average, such as simple, exponential, smoothed, or linear weighted.

Price: Specifies the type of price data the indicator will use to calculate the average. Options include open, close, high, low, median, weighted, or typical price.

Reviews

There are no reviews yet.