ICT Asian Range Indicator, Master Market Timing

For trading ICT Asian Range Indicator based on Asian sessions, this is an excellent tool. Excellent breakout and trend reversal detector.

- Description

- Reviews (0)

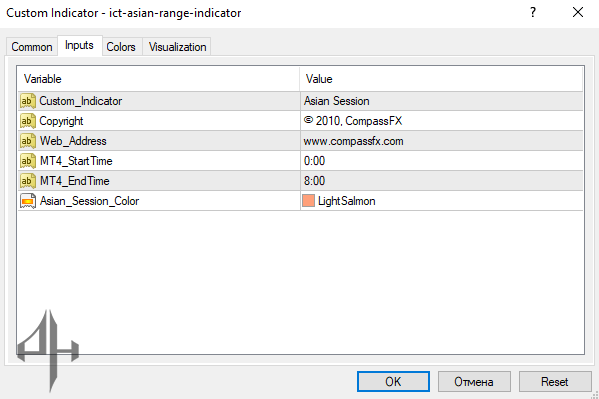

- Indicator Settings

Description

It is likely that you are aware with the ICT Asian Range Indicator approach. The trading approach, however, is based on the Asian session. Before undergoing erratic price movement that propels the London and New York sessions, the forex market should ideally consolidate during the Asian market. As a result, trading with the ICT approach necessitates a deep comprehension of how the market behaves throughout the course of the four trading sessions.

Don’t panic, though, if you are unfamiliar with the tactic. We provide a free download of the ICT Asian Range indicator for MT4. It facilitates trading the breakouts of the Asian session. Investors can trade the breakout to the upside or the downside with the help of the colorful boxes the indicator draws. Only when the price deviates from the box do you need to enter the trade.

Shorter time frames, including one hour, fifteen minutes, and five minutes, are ideal for the ICT Asian Range Indicator. The indicator can be used to trade currency pairings against the Japanese yen. In particular, USD/JPY, EUR/JPY, GBP/JPY, GBP/USD, and EUR/USD are the best combinations for the indicator. In essence, breakout trading will be the indicator’s primary use.

For inexperienced traders, the ICT Asian Range indicator is appropriate. You don’t need to commit the Asian range’s formation times to memory. Once the price breaks out of the Asian market consolidation, all you have to do is locate the range that the indicator draws and execute your trade.

Combining the indication with other tactics and resources is wise. For example, you may want to combine a retouch/retest method with the ICT Asian Range indication. This implies that when the price retests the consolidation period, you will enter.

Buy Signal

When the price breaks above the upper line, which represents the range’s high, a bullish signal is generated.

Sell Signal

When the price drops below the range’s bottom price, it is a negative indicator.

An Example of Trading

The price fluctuation of the British pound in relation to the US dollar is depicted in the image above. Price consolidation during the Asian session is depicted by the circled region. A strong bullish signal was given by the price retesting the range market’s lows. Following this movement, the price falls precipitously, and the subsequent Asian market enters a time of consolidation.

Conclusion

One of the newest trading tactics is ICT. It has turned out to be very successful and profitable. But there are those folks who don’t know what ICT is or how to use it. Based on the varying Asian market, the ICT Asian Range indicator is an ideal tool for identifying potentially lucrative positions. This implies that you will be able to see amazing maneuvers throughout the sessions in London and New York. In the end, your trading gains will increase.

Be the first to review “ICT Asian Range Indicator, Master Market Timing” Cancel reply

Custom Indicator: Allows customization of the preferred trading session for the indicator’s operation.

Copyright: Displays the copyright details for the indicator.

Web Address: Shows the official website of the indicator’s source.

MT4 Start Time: Lets you define the start of the trading day, marking the beginning of the Asian session.

MT4 End Time: Specifies the end time for the daily trading session.

Asian Session Color: Allows you to set the color for the indicator during the Asian session.

Reviews

There are no reviews yet.