The Key Level Indicator vividly illustrates crucial support and resistance zones, helping traders find high-probability entry locations.

Updated:

The Key Level Indicator vividly illustrates crucial support and resistance zones, helping traders find high-probability entry locations.

The finest forex trading tool that can be used with many trading techniques is Metatrader’s key level indicator. When it comes to identifying trading zones where the price is likely to reverse, retest, rebound, or breakout, this multi-timeframe indication is effective. Buyers and sellers typically respond to the defined zones, which are typically primary support and resistance locations. By looking for areas on the charts with strong price rejection as well as other technical analysis, the indicator automatically determines the level.

The reason this MT4 indication is so effective is that it does more than just pinpoint a crucial level on a single frame. Instead, it pinpoints a crucial threshold that is consistent across all time periods. For example, an indication on H4 that detects a key level would likewise be valid on H1 through to the lower time frames. It is, in fact, a special trading instrument.

Moreover, it does not lag behind price and is a leading indicator. Because it prepares a trader for what to expect, it would be beneficial to both experienced and inexperienced traders in their trading attempts. Because it doesn’t interfere with your chart, you’ll also feel at ease using this MT4 indication on your trading dashboard. You still have plenty of room to perform your technical analysis.

The key level indicator can be used for day/intraday trading, swinging, and scalping. The indicator helps you anticipate when market zones are likely to exhibit some kind of support or resistance. In short, it helps you predict price action chances that you can use to decide whether to enter or quit a trade.

You can swiftly move to the lower time frame for an entry chance if you see a sizable price rejection on the higher time frame. When deciding whether to buy or sell, you must let price action direct you.

The lowest time period (M5) is shown in the accompanying chart. Following the third price rejection, you would have made a BUY trade. This example just shows how to use the key level indicator to scalp on a shorter time frame.

The purpose of the MT4 key level indicator is to assist you in making well-informed trading decisions at the appropriate zones. It relieves the strain of having to look for important trading levels on your chart. Lastly, you can download the indicator for free and witness an improvement in your trades.

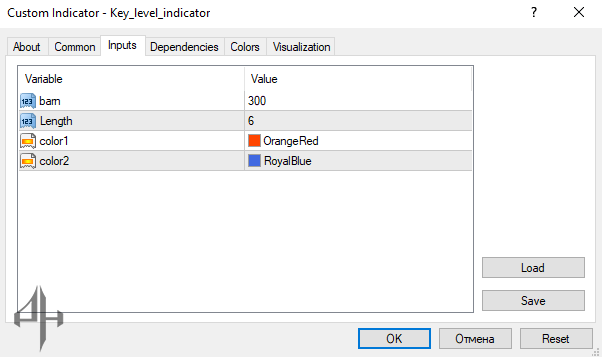

Bam: Sets the value used for the Bam parameter within the indicator.

Length: Defines the initial length of the drawn key level.

Color1: Specifies the primary color for the key level.

Color2: Sets the highlight or secondary color used to display the key level.

Reviews

There are no reviews yet.