MACD 4C Indicator, Explosive Trading Signals

Metatrader 4 MACD 4C Indicator is great for divergence and convergence forex traders. Technical traders can visualize the MACD histogram with the indicator.

- Description

- Reviews (0)

- Indicator Settings

Description

Forex traders that use convergence and divergence trading strategies will find the MACD 4C indicator for Metatrader 4 to be a fascinating instrument. The majority of profitable Forex traders employ technical analysis. Technical forex traders make up a significant portion of the trading community and outnumber fundamental traders. The main purposes of trading tools and indicators are to help traders comprehend trends and predict changes in the price of trading instruments. The MACD, or Moving Average Convergence and Divergence Indicator, is one of the most popular and generally recognized technical indicators among forex traders.

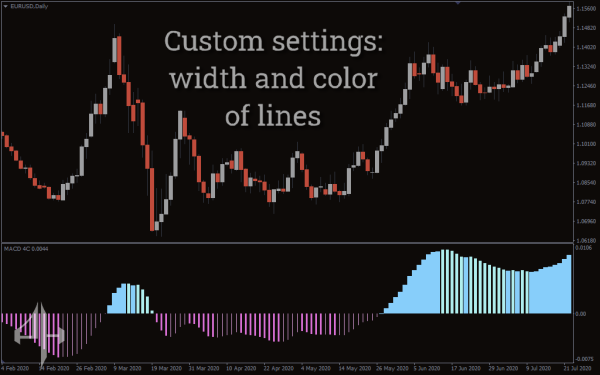

An improved form of the classic MACD indicator is the MACD 4C Indicator. The MACD is shown as a histogram in the MACD 4C. In order to distinguish the trend’s strength, it additionally shows the histogram in four distinct colors.

The MACD histogram will appear as a single color to traditional MACD users. However, the MACD 4C clearly indicates the trend’s strength using four distinct colors. Regardless of the trading platform, traders use it. It plays a crucial role in determining the market’s direction and strength.

The Metatrader 4 Trading Method’s MACD 4C Indicator

The EURUSD M15 chart above illustrates the indicator trading strategy. The indicator displays the histogram in four distinct hues. In the event that the histogram is over the Zero line, it is shown in green and lime. Conversely, below the Zero line, the histogram is displayed in red and maroon.

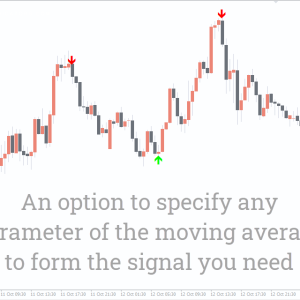

Convergence and divergence are provided by the reliable and optimal MACD 4C indicator. Applying MACD 4C is the most effective way to determine when the trend is about to end. When the market prices and the indicator exhibit opposing behaviors, this is known as convergence or divergence. Because divergence and convergence tell traders about potential shifts in the momentum of the present trend. In order to determine the optimal entry points, forex technical traders combine this information about convergence and divergence with other technical indicators.

To filter trading signals or develop a final trade strategy, for instance, many forex traders mix the MACD 4C indicator with other indicators such as the RSI and stochastic indicator.

The MACD 4C is appropriate for novice traders and makes it visually simple to recognize divergence and convergence. The indicator is used by seasoned forex traders to add confluence with other trading indicators. Additionally, the indicator can be downloaded for free.

Conclusion

An intriguing tool for forex traders using divergence and convergence trading strategies is the MACD 4C indicator for Metatrader 4. Additionally, this technical indicator may be downloaded for free and is appropriate for both novice and seasoned traders. Thus, by providing a visual depiction of the MACD histogram, the indicator will be useful and assist the technical trader. The MACD 4C MT4 indicator’s trading setups and alerts should be verified with other chart-based technical or fundamental indicators, though.

Be the first to review “MACD 4C Indicator, Explosive Trading Signals” Cancel reply

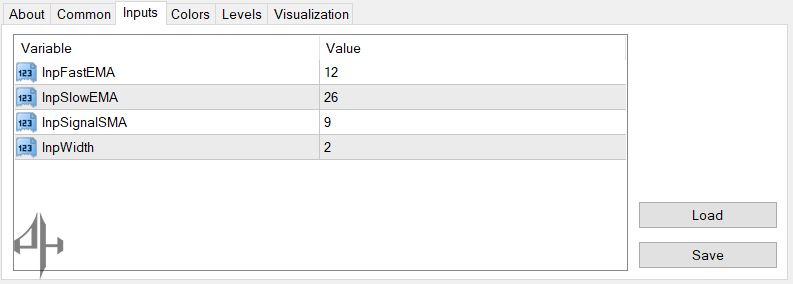

InpFastEMA: Defines the value used to calculate the Fast EMA of the MACD 4C.

InpSlowEMA: Specifies the input value for calculating the Slow EMA.

InpSignalEMA: Sets the value for the Signal line in the MACD.

InpWidth: Adjusts the size of the MACD 4C histogram.

Reviews

There are no reviews yet.