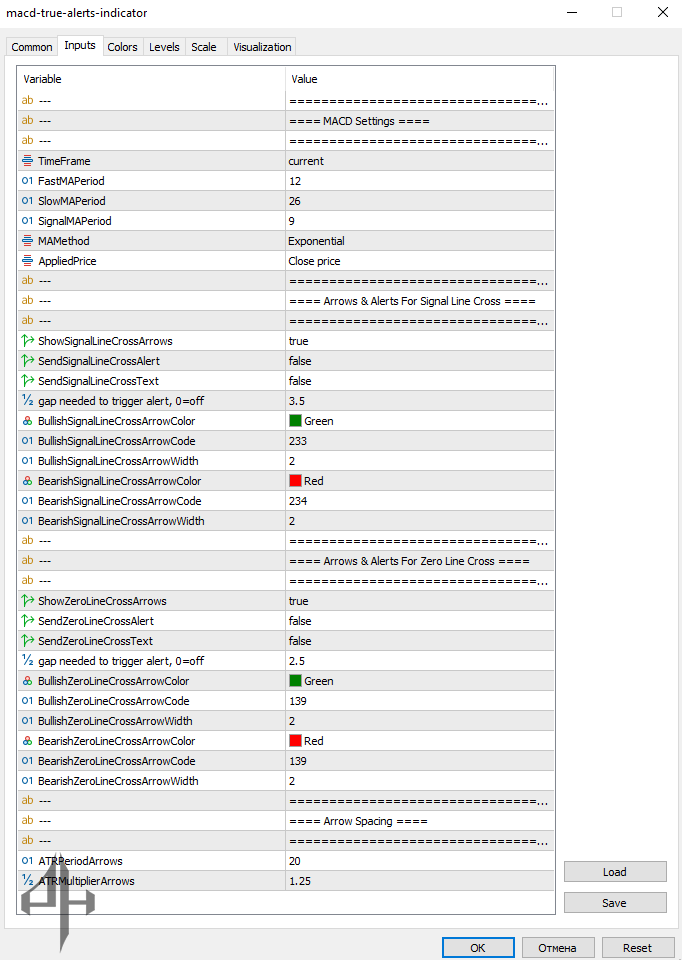

The MACD True Alerts indicator comes with the following default settings:

-

12 for the Fast MA period

-

26 for the Slow MA period

-

9 for the Signal MA period

MACD True Alerts Indicator improves MACD. It identifies trend reversals. Solo trading is possible.

An impulse trend-following indicator that shows the correlation between two MAs (moving averages) is the MACD True Alerts indicator.

To verify entry and exit locations, traders can utilize the MACD (moving averages convergence divergence) True Alerts indicator in conjunction with any forex trading system or strategy.

We will examine the subtleties and characteristics of trading with the MACD True Alerts indicator in this guide.

The MACD indicator was created by Gerald Appel in the late 1970s. The purpose of the MACD indicator is to show shifts in the current market’s strength, momentum, and direction.

In 1986, Thomas Asprey introduced a histogram, or “histogram,” to the indicator in order to forecast MACD crossovers. This is now the norm for technical traders who use the MACD indicator.

Nevertheless, MetaTrader 5’s built-in MACD indicator does not employ the traditional Appell and Asprey methodology. Traders may find this bewildering, particularly if they are unfamiliar with the currency market.

Thankfully, this issue is resolved by the indicator, which applies the conventional Appell and Asprey calculation.

It adds an extra signal line to a portion of the conventional MACD. The total price trend can be ascertained with the use of this signal line. Additionally, when the oscillator increases or the signal and zero lines cross, it displays signals with arrows or other symbols.

In their trading, many traders combine two EMAs. There is typically a slow one and a rapid one. You can improve overall trend detection or even signal entry or exit points by using two EMAs.

By maintaining the slow and rapid lines, the MACD builds on this idea. But it makes use of a signal line.

The fast and slow lines intersect to indicate entry and departure. For instance, you wait for the fast line to get lower before moving to the head of the slow line if you wish to go long. You can then initiate a buy position.

Before leaving, wait for the fast line to reach the bottom. This is most likely the simplest method of trading the indicator.

To gain a better understanding of price momentum, you should examine the MACD True Alerts bars.

The longer the bar, the more momentum the price has. What’s unique is that you can quickly ascertain the strength or weakness of the momentum by comparing it to the momentum of the previous bar or bars.

Although it gives you an extra 9-period signal line, the MACD True Alerts indicator for MT5 functions similarly to the conventional MACD. This might assist you in determining the price’s overall trend.

The MACD True Alerts indicator comes with the following default settings:

12 for the Fast MA period

26 for the Slow MA period

9 for the Signal MA period

Reviews

There are no reviews yet.