MACD True Indicator, Unlock Precise Momentum Signals

An improved version of the classic MACD indicator is MACD True. Recognizing trend reversals is helpful. It can be applied as a technique for solitary traders.

- Description

- Indicator Settings

Description

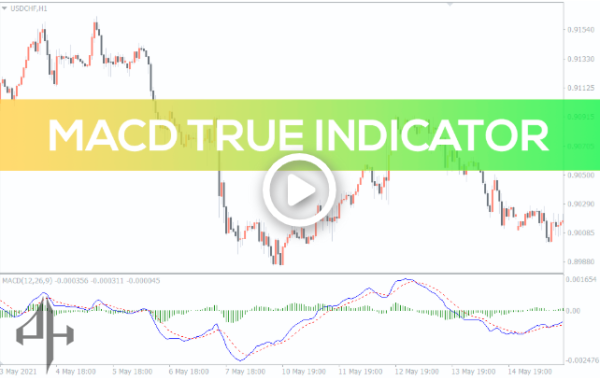

The moving averages’ convergence and divergence, or MACD The link between the two MAs (moving averages) is shown by the true indicator, a momentum trend-following indicator.

The MACD True indicator can be used by traders to verify entry and exit points in any forex trading system or strategy.

We will examine the subtleties and quirks of trading using the MACD True Indicator in this guide.

What is the MACD True indicator?

The MACD indicator was created by Gerald Appel in the late 1970s. The goal of the MACD indicator is to display shifts in the strength, momentum, and direction of the current market.

In 1986, Thomas Aspray added a bar graph, or “histogram,” to the indicator in order to forecast MACD crossovers. This became the norm for technical traders using the MACD indicator.

However, Appel and Aspray’s traditional formula is not used by MetaTrader 4’s default MACD indicator. Traders may find this confusing, particularly if they are unfamiliar with the currency market.

Thankfully, the MACD True indicator allows you to employ the classic method of Appel and Aspray to address the problem.

With its new signal line, it twists a portion of the conventional MACD. You can ascertain the general price trend with the aid of this signal line.

Many traders believe that the RSI and the MACD True Indicator are comparable. This isn’t the case, though.

While the RSI gauges price movement in respect to recent price highs and lows, the MACD True indicator assesses the relationship between two moving averages (EMAs).

Although these indicators show market momentum, they can sometimes yield inconsistent results since they measure different elements.

For instance, the market may be leaning towards buying at current prices if the RSI shows a value above 70 for an extended period of time. However, the market’s buying momentum appears to be continuing to grow, according to it.

How to use the MACD True indicator?

In their trading, many traders combine two EMAs. Typically, there are two types: rapid and slow. Enhancing overall trend detection or even signal entry or exit points is the goal of using two EMAs.

By maintaining a slow and rapid line, the MACD builds on this idea. Nevertheless, it uses a signal line.

Entry and exit signals are provided by the fast and slow line crossings. If you wish to travel long, for instance, you wait for the quick queue to drop below before crossing to the head of the slow queue. You can then start a buying position.

Before getting out, wait for the quick queue to cross in the direction of the bottom. The simplest way to trade the MACD True indicator is probably this one.

To gain a better understanding of price momentum, you should examine the MACD True bars.

The longer the bar, the more momentum the price has. This is unique because it makes it simple to assess the strength or weakness of momentum by comparing the momentum of the current bar to that of the previous bar or bars.

Trading strategy using the MACD True indicator

The appearance of divergence and convergence can signal an impending trend reversal.

Consequently, you might consider opening positions against the current short-term trend.

Buy Setup:

-

The MACD should cross below the signal line.

-

The MACD should also cross below the zero line.

-

Enter a long position when the MACD crosses back above its signal line.

-

Place your stop-loss near the recent swing low and set your take profit near the next resistance level.

Sell Setup:

-

The MACD should cross above the signal line.

-

The MACD should also cross above the zero line.

-

Enter a short position when the MACD crosses back below its signal line.

-

Place your stop-loss near the recent swing high and set your take profit near the next support level.

Conclusion

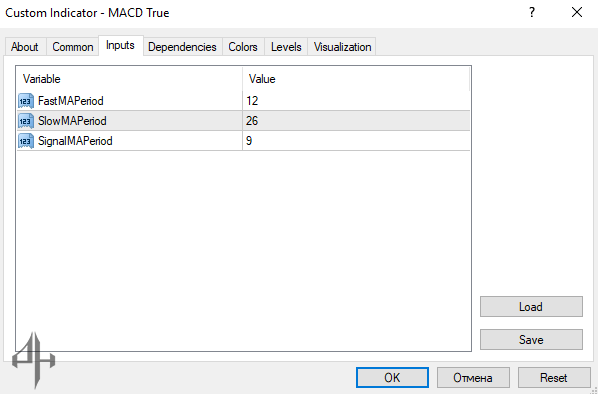

Although it gives you an extra 9-period signal line, the MACD True indicator for MT4 functions similarly to the conventional MACD. You can use this to analyse the general direction of prices.

The default parameters for the MACD True indicator are:

-

Fast MA period: 12

-

Slow MA period: 26

-

Signal MA period: 9