Position Size Calculator Indicator, Confident Trading Decisions

Professional traders use the Position Size Calculator Indicator to determine risk appetite and avoid overtrading. Sets entry, stop loss, and position size automatically.

- Description

- Reviews (0)

- Indicator Settings

Description

If you’re a skilled trader, you can use the position size calculator Indicator to help you prevent overtrading and determine your risk appetite in advance. Prepares the entry point, stop loss, and position size automatically. To make trading easier, traders are constantly searching for new tools. Only a small number of technical indicators aid in position sizing and risk management, even if many offer buy and sell signals. Determining the maximum possible loss is a component of risk management. As a result, you prevent blowing the account by not risking too much of your trading cash.

Even while you can manually determine the optimal trading position size, there are situations when you need to execute the transaction more quickly, particularly when scalping. The Position Size Calculator Indicator for MT4 free download will help with this.

Using your account balance, risk tolerance, currency pair, and other MT4 platform data, it determines the optimal position size. The optimal stop loss level is then established. Calculations don’t require you to return to the charts. A panel on the upper left portion of the trading charts displays the stop loss, position size, and other details. All forex pairings and assets can be traded using the indicator.

How to Use The Position Size Calculator Indicator for MT4

The indicator is really simple to use. Start by getting the indicator for free from our website. Just turn on the indicator, and presto! Ideal trade entry and stop-loss points are automatically determined and marked with lines. Additionally, it displays the position size, risk money, account balance, and risk %. This lets you know how much you could lose if the trade doesn’t work out. The indicator will automatically set the risk to 1%. You can change the position size and risk tolerance, though. Just adjust the risk percentage or risk money (the amount of money you are willing to risk) if your risk appetite is 2%.

Example of a Real Trade Position Size Calculator Indicator

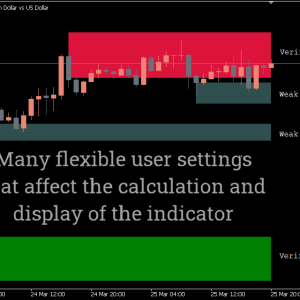

The Euro’s price movement in relation to the US dollar is displayed on the chart. On the left side of the price chart, the panel displays the risk money and position size. In this demo account, for example, the position size is 1.16 lots. Out of the $5,000 account balance, $50 represents the risk money, or 1% of the overall account value.

A purchase signal is shown by the indicator setting the stop loss below the entry level. With a stop loss of 1.10414 and an entry-level of 1.10457, the risk tolerance is 43 pip.

All you have to do is complete this information and you’re ready to go. The 1:3 risk-reward ratio can be used to determine the take-profit threshold. By using the trailing stop, you can increase your profits.

Conclusion

By adding risk management to your trading approach, the Position Size Calculator Indicator elevates your trading to a new level. It establishes the appropriate stop loss level and position size. As a result, you trade sensibly and keep your account from blowing. For inexperienced traders in particular, it helps prevent overtrading. You can trade more quickly and effectively without jeopardizing your account with automatic position sizing. It is unquestionably a technical tool that you ought to possess.

Be the first to review “Position Size Calculator Indicator, Confident Trading Decisions” Cancel reply

Entry-Level: Specifies the price at which the trade will be initiated.

Stop-Loss Level: Defines the price point where the trade will automatically close if the market moves against the position.

Risk: Sets the maximum percentage of your account you’re willing to risk on the trade.

Money Risk: Indicates the specific monetary amount you’re willing to risk.

Use Money Instead of Percentage: Displays the risk amount in currency rather than as a percentage.

Use Equity Instead of Balance: Calculates stop-loss levels based on account equity rather than the balance.

Font Color: Configures the text color for the trading panel display.

PS Font Color: Sets the text color specifically for the position size information.

Entry Line Color: Determines the color of the line that marks the trade entry point.

Stop-Loss Line Color: Determines the color of the line that marks the stop-loss level.

Reviews

There are no reviews yet.