Time Zone Indicator, Dominate Every Market Moment

The trading sessions, their times, and the market’s current session are shown by the Time Zone Indicator.

- Description

- Reviews (0)

- Indicator Settings

Description

Market sessions, together with the time and session in which the market is currently trading, are displayed by the Time Zone Indicator. With the exception of Saturdays and Sundays, forex markets are open twenty-four hours a day. The market does, however, have many sessions that start in various time zones. The Asian, European, and North American time zones are these.

It has been noted that the forex market responds differently depending on the time zone. Furthermore, it is not suggested to place orders in all time zones. Certain trading sessions are more turbulent and liquid than others, like the London sessions. There are other sessions that are thin, like the Sydney session. As a result, each trader needs to monitor each forex time zone, which may be done with the Time Zone Indicator.

The Foundation

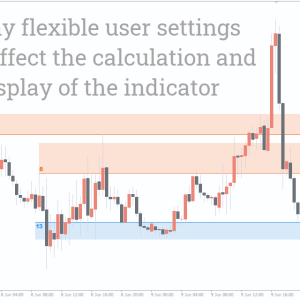

The trading sessions, their times, and the market’s current session are shown by the Time Zone Indicator. The trading sessions in Tokyo, Sydney, London, and New York are displayed by this indicator. As can be seen in the figure below, this indication shows the current trading session in red on the chart.

The market is presently in the Sydney trading session, according to the USD/JPY H1 chart above. This is shown in red by the Time Zone Indicator. The indicator will update the chart to the following session after the Sydney session concludes.

With the help of this indicator, traders may open positions by knowing when a crucial trading session starts. With the use of this indicator, traders may also determine when a given session ends so they can close their positions. Forex traders can therefore use this indication to determine when to enter and quit the market.

How to use the Time Zone Indicator

Traders need to understand the features of every trading session in order to use the Time Zone Indicator for MT4 efficiently.

The Asian sessions are the first to open. The Tokyo and Sydney sessions are part of the Asian sessions. About 20% of all forex transactions take place during these sessions.

Low trade volumes might sometimes result in very little liquidity. The majority of currency pairings will trade inside a range as a result of this low liquidity. Economic news from Australia, New Zealand, and Japan is released during the Asian sessions. Pairs containing JPY, AUD, and NZD exhibit stronger moves.

The London session is known as the Second Session. Of all the sessions, the London session is the biggest. The London session handles more than 32 percent of all transactions. Because of its huge trading volume, the London Session is renowned for its strong liquidity.

The spread is at its lowest during this session. Between the London period and the New York Session, volatility somewhat decreases. Sometimes, right before the session closes, the market’s trend reverses, and traders in London choose to lock in their gains.

The New York session is the final one. After the London session, this one is the second largest. Approximately 19% of all FX transactions take place during the New York session.

The significant market-moving potential of this session is well-known. In actuality, the USD is used in 85% of all trades. When the London Session overlaps, the Session has strong liquidity. This overlap is where the forex market sees the most trading activity.

According to this explanation, trading with this indicator is most profitable when the London and New York sessions coincide. This is due to the fact that the currency market is at its most turbulent and liquid during this time.

Because London, the largest session with the largest traders, overlaps with New York, the second largest session, there is more liquidity and volatility during this overlap.

Market makers really start to trade at this point. As a result, expert traders should place their buy and sell orders at this moment.

Conclusion

The Time Zone Indicator for MT4 aids traders in making important decisions by letting them know which trading sessions the market is in.

Be the first to review “Time Zone Indicator, Dominate Every Market Moment” Cancel reply

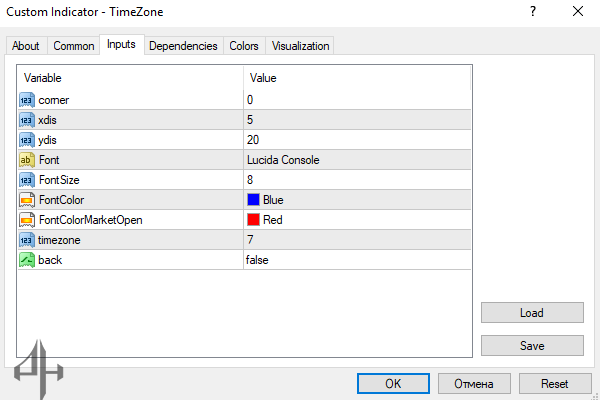

The MT4 settings for the Time Zone Indicator include the following parameters.

Corner: The corner of the chart where the indicator is displayed.

Xdis: The horizontal (X-axis) distance from the chart corner.

Ydis: The vertical (Y-axis) distance from the chart corner.

Font: The font style used for the indicator text.

Font Size: The size of the indicator’s font.

Font Color: The color of the indicator’s font.

Font Color Market Open: The font color indicating the market is open.

Time Zone: The time zone setting for the indicator.

Back: The background (or background color) of the indicator display.

Reviews

There are no reviews yet.