Trading Sessions Open Close Indicator, Essential Trading Sessions

Trading Sessions Open Close Indicator helps assess trading session price range and behavior. This data is useful for forecasting and trading.

- Description

- Indicator Settings

Description

The range and behavior of prices throughout a trading session can be better understood with the help of the Trading Sessions Open Close indicator. You may be familiar with the various trading sessions if you have been trading forex for some time. You won’t be able to chart session changes, and you may become confused about when a session begins and ends. This is a specially designed indication for this use.

What is the Trading Sessions Open Close indicator?

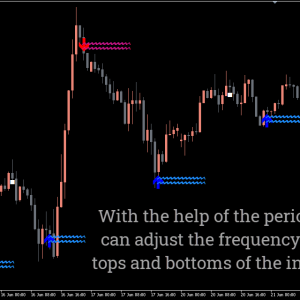

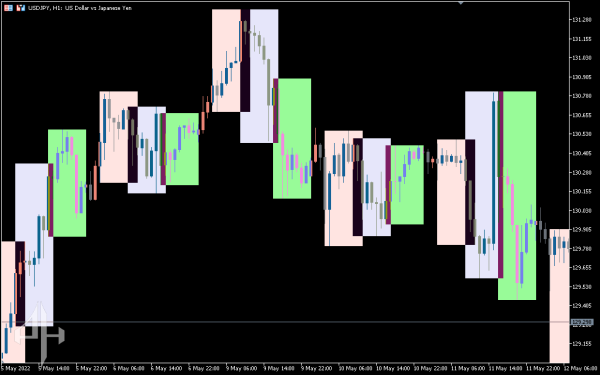

An indicator of session separation is Trading Sessions Open Close Indicator. On your chart, it makes a distinction between Asian, European, and American sessions. The most erratic sessions or hours are available to you without any problems. Colorizing every trading session is an option. The current trading session is now known to you.

The indication is helpful in figuring out the price range and action during a specific session.

How to use the Trading Sessions Open Close indicator

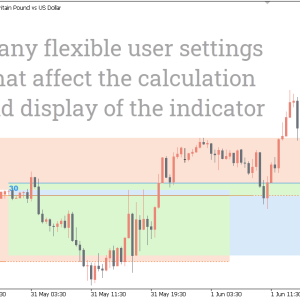

The indicator’s two primary purposes are to ascertain:

- price pattern (range, trend, or countertrend) within a specific session.

- range of prices during a trading session.

You can forecast or trade the upcoming price leg if you are aware of these two factors. The maximum and lower price limits are indicated by the trading session’s color. You have the option of trading a range breakout or a bounce.

Trading Sessions Open Close Indicator trading techniques using indicators

Let’s examine trading tactics that are based on this indicator.

Buy Setup:

-

Monitor for the close of the Asian session and the start of the European session.

-

If the price breaks above the Asian session range, consider a buying opportunity.

-

Enter a long position after the close of a bullish candle.

-

Place the stop-loss below the recent consolidation area.

-

Set the take profit target at 1.5 times the stop-loss distance.

-

Avoid trading if the spread during the session is 50 pips or higher.

Sell Setup:

-

Observe the close of the Asian session and the start of the European session.

-

If the price breaks below the Asian session range, consider a selling opportunity.

-

Enter a short position after the close of a bearish candle.

-

Place the stop-loss above the recent consolidation zone.

-

Set the take profit target at 1.5 times the stop-loss distance.

-

Avoid trading if the spread during the session is 50 pips or greater.

Conclusion

Despite all of the indicator’s benefits, you should utilize it with caution when trading in real time. Before using a strategy in live trading, always test it on a demo account or backtest the data.

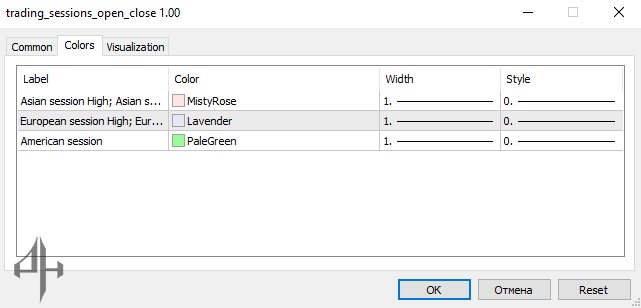

Only the trading session colors can be customized in the indicator settings.