Volatility Quality Zero Line Indicator

In the list of indicators for comparable types, the Volatility Quality Zero Line indicator has historically been the top indication.

- Description

- Reviews (0)

- Indicator Settings

Description

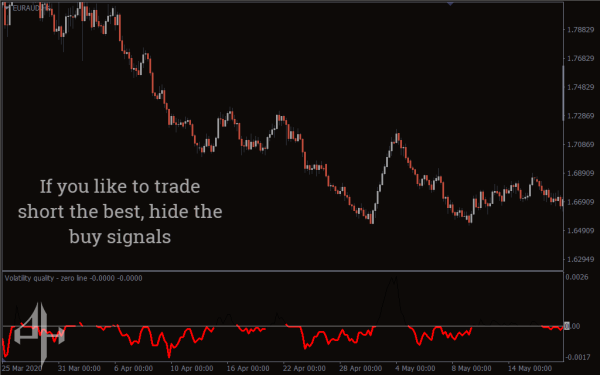

The Volatility Quality Zero Line Indicator serves as a volatility indicator as well as a trend trading indicator. It uses two colors—red and green—to represent the price movement. Whereas the red line indicates a downtrend, the green line indicates an uptrend in the market. Regarding its volatility duties, the market’s level of volatility is shown by how far the line is from the zero line.

The Volatility Quality Zero Line Indicator, created by Thomas Stridsman, is a version of this one. However, the Volatility quality zero line indication is less sensitive than its source indicator. It is more resilient to false breakouts because it does not provide as many indications as the source indicator. Its values are derived from a Weighted Moving Average’s Open High Low Close values. On the down side, though, the market volatility indicator may take a while to respond to changes in price.

How to Trade Using the Volatility Quality Zero Line Indicator

Following the signals is how to use the indicator to trade forex. When the line changes from red to green, go long…

…And when the line changes from green to red, stop short.

When the line crosses the zero line, these signals occur at the same time.

Utilizing the Indicator for Trade Management

Using the Volatility quality zero line indicator for trade entries is only one aspect of the process. Understanding how to use the indicator to establish stop losses and take profits is the other component.

Take profit

To set take profit levels with this indicator, close trades at the start of new signals. For example, exit all long positions when the volatility trading indicator shifts from green to red. Similarly, exit all short positions when the indicator changes from red to green.

Stop loss

One way to determine your stop loss is by identifying the most recent high or low before the Volatility Quality Zero Line indicator generates a signal. For instance, after the indicator switches from bullish to bearish, mark the latest high and place your stop loss just above it. This approach relies on the principle that a downtrend requires lower highs and lower lows, while an uptrend requires higher highs and higher lows.

This stop loss method can also help filter trades. If the most recent high or low is far from the new signal, it may indicate weak market momentum, suggesting it might be better to avoid that trade, as the potential profit may be limited.

Who Can Benefit Most from the Volatility Indicator?

The Volatility Quality Zero Line Indicator is suitable for all forex traders. It is user-friendly and does not require prior technical knowledge to implement effectively.

Be the first to review “Volatility Quality Zero Line Indicator” Cancel reply

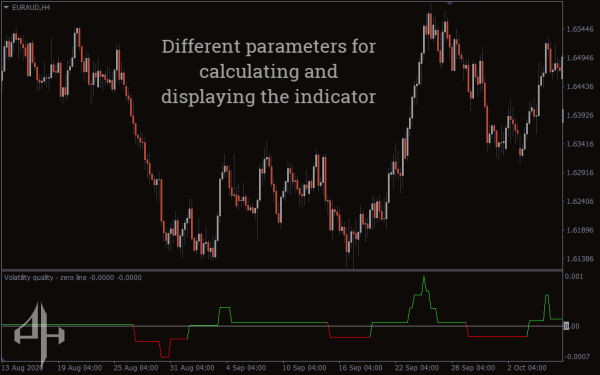

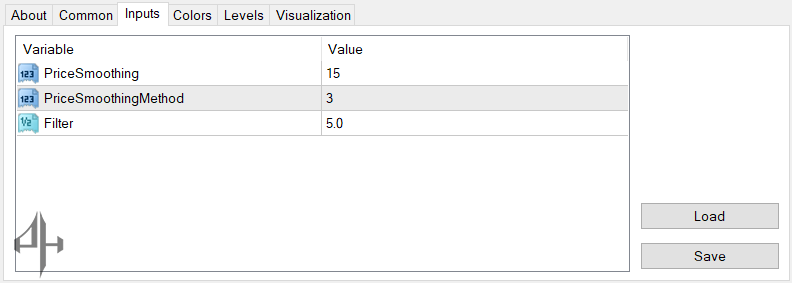

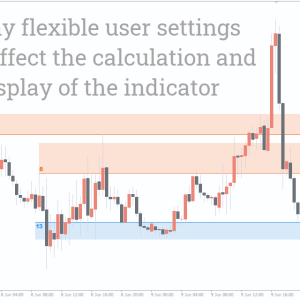

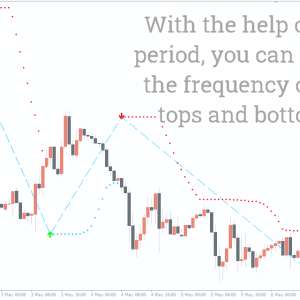

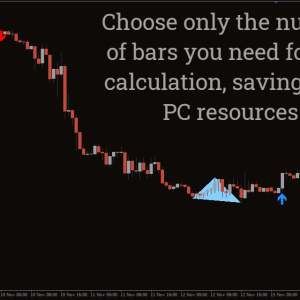

Price Smoothing: This setting controls the volatility of the indicator’s signals. Increasing the value above the default of 15 produces smoother, less volatile signals, while lowering it results in more frequent and volatile signals.

Price Smoothing Method: The forex volatility indicator offers three smoothing methods (1, 2, and 3). Method 2 provides the smoothest lines with the fewest signals, making it ideal for tracking major trends. Methods 1 and 3 generate more frequent signals but with less smoothness.

Filter: Similar to the other settings, the filter helps reduce signal noise. Increasing the filter value smooths the indicator further and decreases the number of signals.

Reviews

There are no reviews yet.