Volume Weighted MA (VWMA) Indicator, Supercharge Your Trading with VWMA

One well-liked MT4 indicator for trend research is the Volume Weighted Moving Average (VWMA). displays the price’s real weighted moving average.

- Description

- Reviews (0)

- Indicator Settings

Description

The moving average of the price and volume data are used to create the Volume Weighted MA (VWMA) Indicator. This indicator functions similarly to a typical moving average. The sole distinction is that bars with higher volume are given more weight than bars with less trading activity.

Volume Weighted MA (VWMA) Indicator is a trend-following trading indicator that is both flexible and adaptable. In addition to novices, seasoned experts find this MT4 indicator to be simple and helpful for examining market patterns. Furthermore, a volume-weighted moving average can be viewed as a dynamic level of price support or resistance.

In MT4, the volume weighted moving average works well for all kinds of timeframes. For a more accurate gauge of market mood, experienced traders use VWMA across many timeframes. Additionally, this indicator facilitates trading in a wide range of financial instruments, such as stocks, commodities, metals, FX, and cryptocurrencies.

How to use MT4’s Volume Weighted MA (VWMA) Indicator for trading

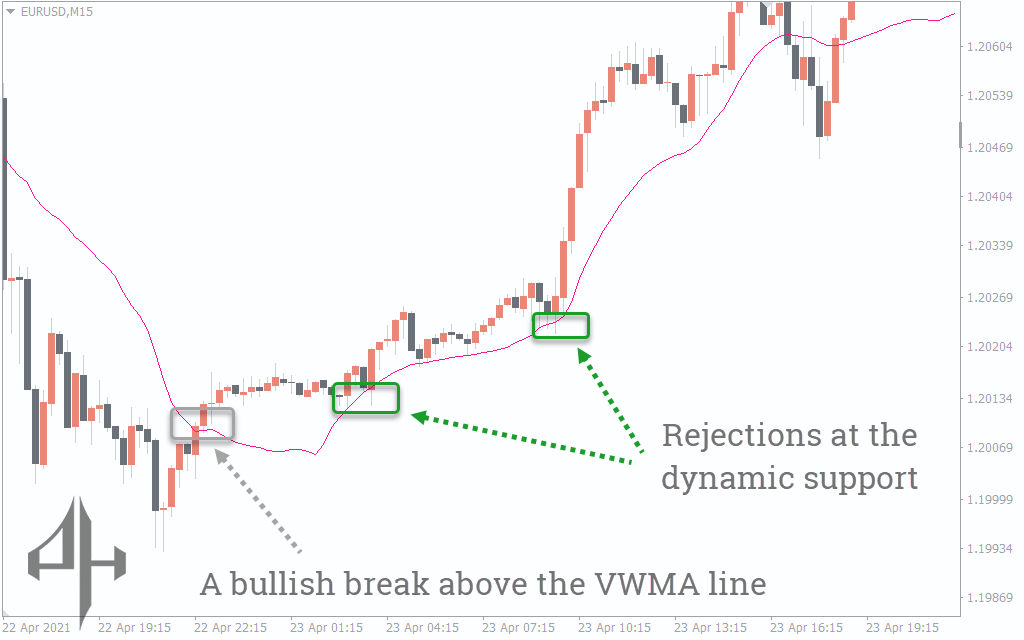

Your chart will look like the above picture once you download and install Volume Weighted MA in your MT4 platform. The indicator has the appearance of a standard moving average. Volume Weighted MA (VWMA) Indicator is quite simple to trade with if you know how to use SMA and EMA.

The indicator’s reaction method differs slightly from the simple moving average. A moving average typically responds in accordance with each price candle’s open, high, low, and close. Nevertheless, Volume Weighted MA (VWMA) Indicator only selects the candle with a high trading volume in order to calculate the asset’s moving average value.

Based on how the price and VWMA value interact, we ascertain the market trend. When the price exceeds the indication value, the trend is bullish. On the other hand, when the price falls below the current VWMA level, we view the market trend as negative.

You can use a variety of price-action tactics to open a trade within the trend direction once you have accurately identified a market trend. For instance, when the price respects the VWMA slope as support in an uptrending market, you might initiate a buy order.

In contrast, the price must first drop below the volume-weighted average level in order for a sell order to be placed. The VWMA line should then be seen as a barrier by the price whenever it returns to the indicator level.

The volume-weighted average is a dynamic price breakout level used by aggressive traders. This indicates that a possible breakout trading opportunity is present whenever the price breaks a VWMA level.

Conclusion

A moving average indicator with multiple uses is the Volume Weighted MA. It displays possible levels for trade entries in addition to indicating the market trend. Additionally, you can use the Volume Weighted MA (VWMA) Indicator lines as your active orders’ primary stop-loss level. It can also be used to plot crossover trend signals in conjunction with your preferred moving average.

Be the first to review “Volume Weighted MA (VWMA) Indicator, Supercharge Your Trading with VWMA” Cancel reply

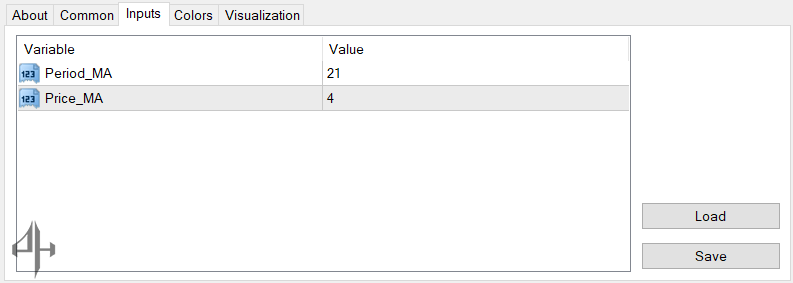

Period MA: Sets the length of the volume-weighted moving average. Based on our review, a 21-period is optimal for short-term and intraday trend analysis.

Price MA: Defines the reaction period for the VWMA. A 4-period price MA means the indicator selects the candle with the highest volume from the last four candles.

Reviews

There are no reviews yet.