ATR Trailing Stop Indicator

Best ATR Trailing Stop Indicator stop loss for MT4. Best Stop loss calculator based on volatility using Average True Range.

- Description

- Reviews (0)

- Indicator Settings

Description

Successful forex traders place stop losses at optimal levels. There are various stop-loss calculators. ATR Trailing Stop Indicator for MT4 is the greatest indicator that calculates volatility using Average True Range and gives forex traders the best trailing stop loss.

The ATR Trailing Stop Indicator for MT4 helps forex traders determine trend, volatility, and entry and exit points. Many auto trading or EA-based trading tools employ average True Range-based trailing stops as stop loss calculators since they are the best.

How to Utilize the Metatrader 4 ATR Trailing Stop Indicator

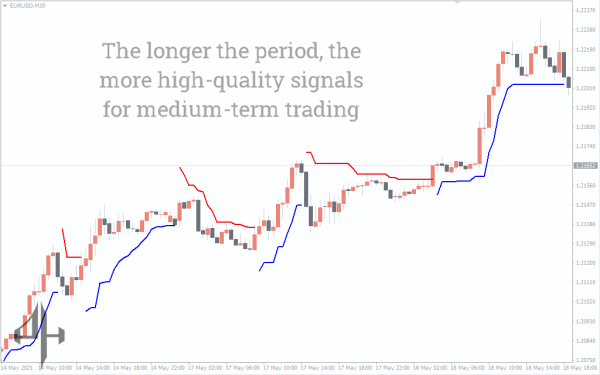

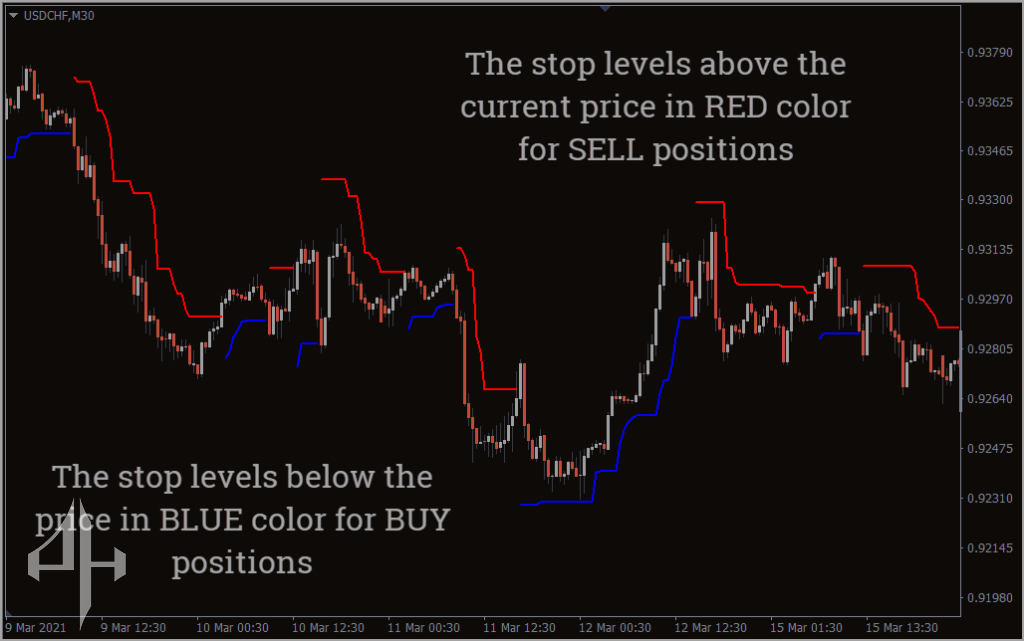

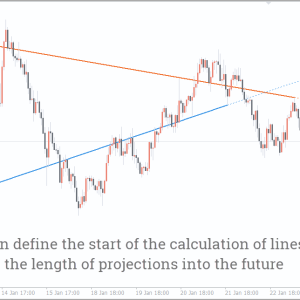

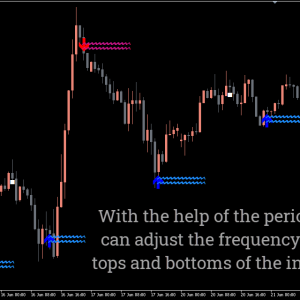

The ATR Trailing Stop Indicator is on display in the GBPJPY H1 chart above. For SELL situations, the indicator shows the trailing stop levels above the current price in red. Conversely, for BUY situations, the indicator displays the stop levels in BLUE below the price.

To find the trend and follow it until the opposing trend appears, many traders employ the Average True Range. For instance, until the Average True Range Trailing Stop Loss MT4 indicator becomes red, the trader in a BUY position will keep the position open. The forex trader will be able to ride the trend to the end in this scenario.

Since the ATR is the finest volatility calculator, traders use the ATR Trailing Stop Loss indicator to determine when to enter and leave a trade. When the indicator becomes blue, forex traders often buy. On the other hand, when the indicator turns red, they SELL. To validate the entry positions, it is advised to integrate the signals with price action and additional technical indicators.

Because it gives a glimpse of market volatility, this indicator will be very helpful to novice forex traders. Additionally, they are given the optimal stop loss point via the ATR Trailing Stop Indicator for MT4. This indicator is used by seasoned forex traders to determine trailing stops, trend direction, entry and exit points, and to combine these indicators with other technical systems. The multiplier is used to determine the optimal indicator settings.

Conclusion

For all kinds of forex traders, the MT4 ATR trailing stop loss indicator is a vital tool. Because the market can adjust to volatility and the optimal stop loss is provided by the Average True Range-based stop loss. To safeguard the position, the indicator simultaneously offers a trailing stop loss. Since the volatility of each currency pair varies, forex traders should experiment with different indicator settings.

Be the first to review “ATR Trailing Stop Indicator” Cancel reply

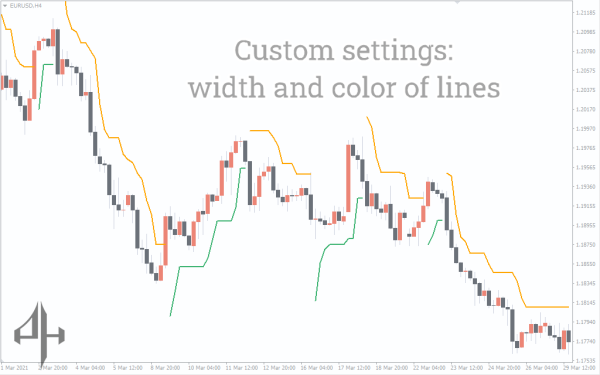

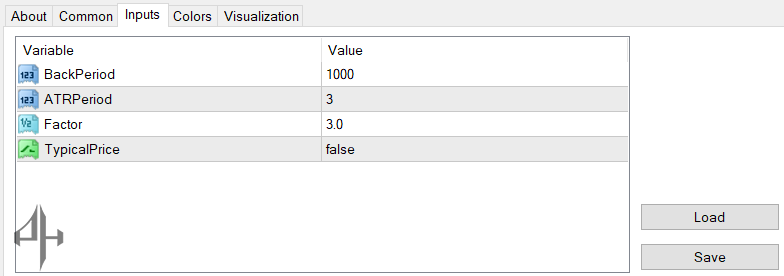

The indicator offers options to modify the Factor settings’ ATR multiplier. As the ATR value is multiplied by this number, the trailing stop loss increases with the higher factor choices.

BackPeriod: Displays the chart’s ATR indicator for this time frame.

ATRPeriod: The time frame used to calculate the Average True Range.

Factor: The ATR multiplier; a higher number will cause the stop to expand.

Typical price: TRUE calculates the ATR using (High+Low+Close)/3, whereas FALSE uses closing prices.

Reviews

There are no reviews yet.