Chandelier Exit Indicator, Seize Control

A volatility-based indicator called Chandelier Exit was developed to allow traders to remain in a trade until a clear trend reversal occurs. By using the Chandelier Exit indicator, a trader can prevent early exit and achieve maximum profits in pip values, as will be explained below.

- Description

- Reviews (0)

- Indicator Settings

Description

The Chandelier Exit Indicator signal assists forex traders in avoiding early exits and extending their stay in the trend. The indicator offers a trustworthy trailing stop loss and is based on a measurement of volatility using the Average True Range, or ATR. Additionally, when the indicator and price cross paths, the indicator offers the finest entry points. Traders can further modify the indicator to fit various trading instruments by using the Average True Range multiplier, or ATR. Consequently, this Metatrader indicator offers all the inputs required to trade the trend profitably.

How can the Chandelier Exit Indicator MT4 Indicator be used to BUY and SELL?

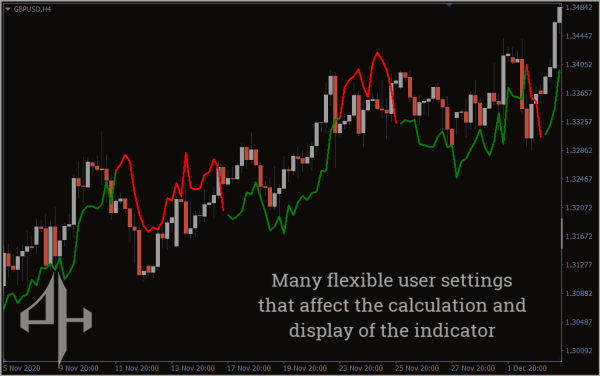

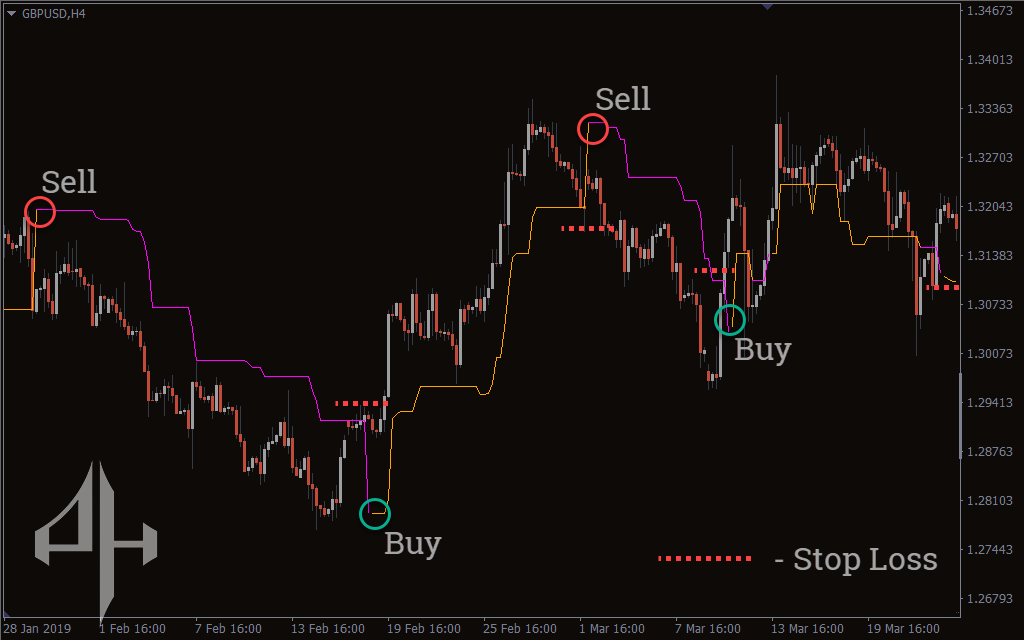

The trading indications produced by the Chandelier Exit MT4 Indicator between December 2, 2020, and January 29, 2021, are displayed in the GBPUSD H4 chart above. Since the values are dynamically determined based on the Average True Range (ATR) data, the indicator levels offer the best levels of support and resistance. Therefore, traders may view a violation of these levels as an entry point.

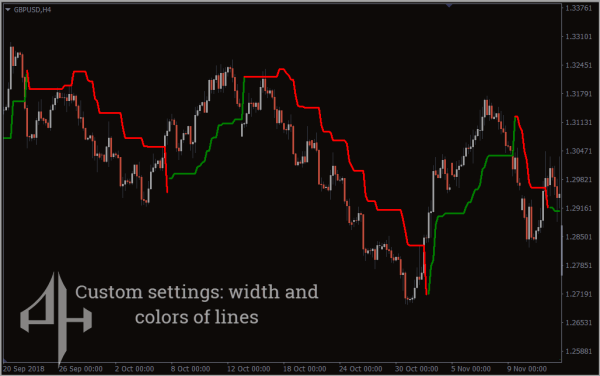

On September 4, 2020, and October 2, 2020, the prices in the preceding chart break above the Chandelier Exit Indicator and cross over it from down to up, producing BUY signals. On the other hand, SELL signals were produced by the downward crossover.

How can the Chandelier Exit Indicator Metatrader be used to determine the optimal exit levels?

The Chandelier Exit Indicator mt4 indication is displayed in the GBPUSD H4 chart above, which spans the period from December 2, 2020, to January 29, 2021. The ATR values and the ATR multiplier applied to the indicator parameters determine the stop loss levels.

The stop loss fluctuates in real time, assisting the forex trader in maintaining the trend for as long as feasible. The trader can therefore ride the trend till it runs its course. To safeguard an active trade, the dynamic stop-loss effectively serves as a trailing stop-loss level.

In a downtrend, the stop loss levels show up above the price. The Chandelier Exit Indicator, on the other hand, shows the levels below the price during an upswing.

When it comes to entrance signals and exit levels, the indicator is straightforward to understand. For both novice and seasoned forex traders, it is therefore quite dependable.

Conclusion

In essence, the Chandelier Exit Indicator is a trailing stop loss instrument. Nonetheless, it aids the trader in recognizing the trend as well. The indicator gives the trader the optimal stop-loss levels by calculating the exit levels using the ATR (Average True Range) data. Traders can use it to ride the trend in addition to using it as a trend detection indicator. All things considered, this MT4 indicator gives trend traders the best outcomes when it comes to spotting new trends, following them, and exiting at the optimal times.

Be the first to review “Chandelier Exit Indicator, Seize Control” Cancel reply

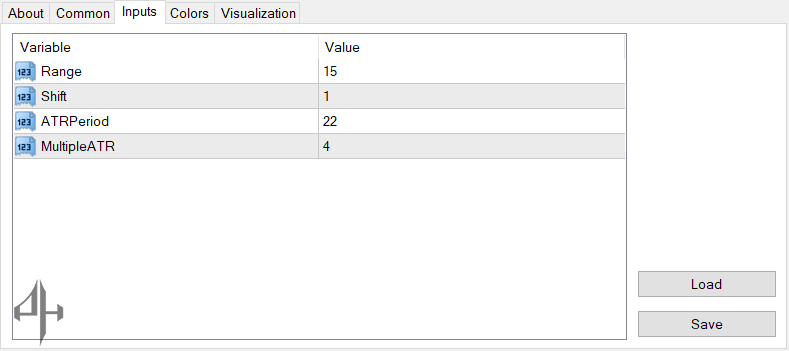

The following are the parameters of the Chandelier Exit Metatrader Indicator.

-

Range – Refers to the highest and lowest prices within the selected time periods, which are used for the indicator’s calculations.

-

Shift – Determines the horizontal displacement of the indicator on the chart.

-

ATR Period – Sets the period for the Average True Range (ATR), which is used in the calculation of the Chandelier Exit indicator.

-

ATR Multiplier – Adjusts the stop-loss distance by applying a multiplier to the ATR value, affecting how far the indicator is placed from the price.

Reviews

There are no reviews yet.