VWAP Bands Indicator, Unleash Precision in Market Analysis

For MT4, best VWAP (Volume Weighted average Price) bands indicator. To BUY low and sell high, determine the fair price, optimal entrance, and exit price.

- Description

- Reviews (0)

- Indicator Settings

Description

Moving averages and Bollinger bands are two other indicators that are comparable to the VWAP Bands Indicator Volume weighted Average Price Bands indicator. In this particular indicator, the volume is given a greater amount of weight. An excellent understanding of the levels of support and resistance in the chart may be gained from the indicator. In addition, the indicator provides information regarding the true worth of a trade instrument. Consequently, this makes it possible for forex traders to recognize excellent trading opportunities to BUY LOW and SELL HIGH currencies.

The comprehension of price action and fair value price can be combined by traders in the foreign exchange market. Additionally, make use of the extreme bands in order to determine the best feasible entry price. As a matter of fact, the determination of the price that represents fair value is essential to the success of every trader.

Trading signals based on the VWAP Bands Indicator MT4

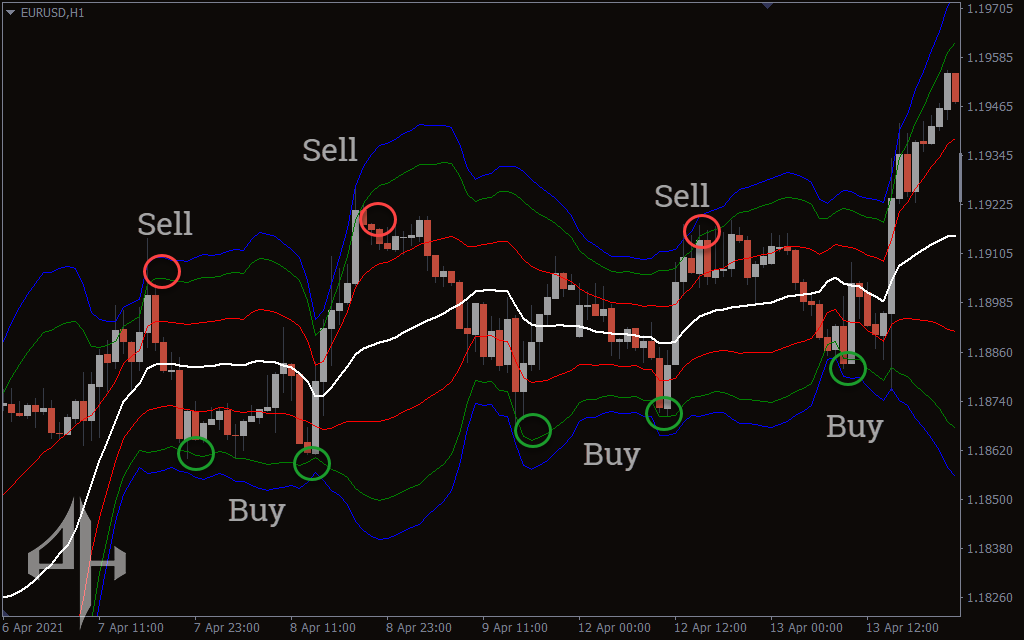

The VWAP Bands Indicator are displayed on the EURUSD H1 chart that can be found above. The Volume Weighted Average Price (VWAP) of the trading instrument is represented by the middle line within the chart. In addition, the upper and lower bands are created by arriving at the standard deviation from the midline by the calculation. Price value at the midline is the price at which the trading instrument is considered to be of fair value.

The best time to buy is at the extreme lower band on, and the best time to sell is at the extreme higher band. The greatest entry price is to buy at the extreme lower band on. Traders have the ability to maintain the position and exit the trade when they receive the opposite indication. Foreign exchange traders, on the other hand, ought to concentrate on the price action that occurs around the lower and upper bands and verify the trading signals that come from the VWAP Bands Indicator.

Understanding the fair value of any trading instrument and taking advantage of opportunities to buy low and sell high can be beneficial to new traders. On the other hand, advanced traders have the ability to adopt a TOP-DOWN method and apply the VWAP Bands Indicator to different time frames without any restrictions. Foreign exchange traders are able to plan and execute winning transactions by first gaining a knowledge of the indicator values and then comparing those values to the position of the upper and lower bands.

As the indicator begins to add more weight to the volume, it begins to respond during trading sessions that are seeing high volume. Nevertheless, the reaction is somewhat less noticeable during the other sessions. Additionally, intraday traders have the ability to apply the signal across different time frames in order to provide a price profile that is fair. Traders who focus on day trading, short-term trading, and long-term trading can all benefit from using this indication. Indicator files for the Ex4 platform will be made available for free download to traders.

Conclusion

It is true that the Volume Weighted Average Price, often known as VWAP Bands Indicator, is the most effective forex trading indicator for determining the price at which any trading instrument is trading at its true value. Not only do the upper and lower bands offer the most advantageous entry points for buying and selling in the market, but the mid-line also provides an outstanding price reference point. An additional benefit is that the VWAP Bands Indicator MT4 ex4 file can be downloaded without cost.

Be the first to review “VWAP Bands Indicator, Unleash Precision in Market Analysis” Cancel reply

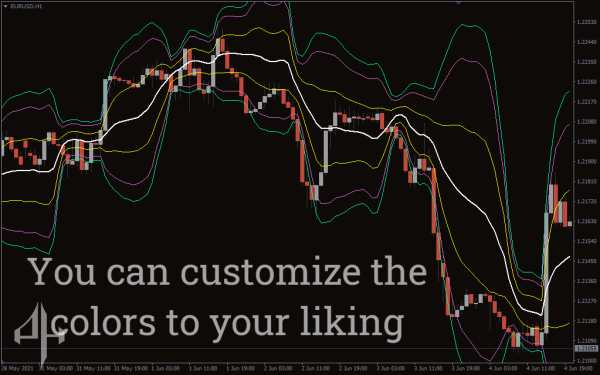

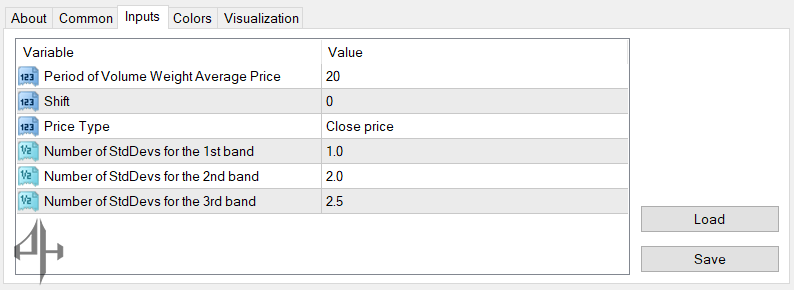

When the input value setting of the deviations multiplier is set to zero, traders have the ability to disconnect the bands.

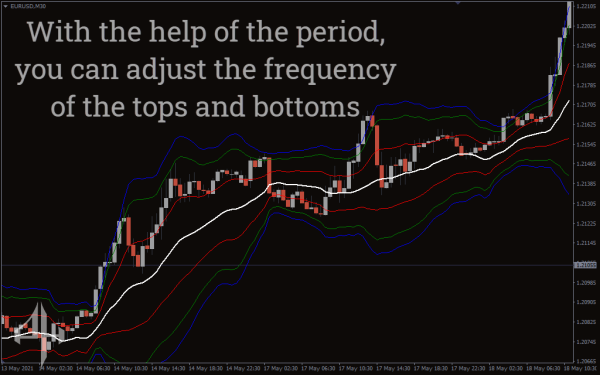

The period for computing the indicator values will be referred to as the Period of Volume Weight Average Price.

Shift: Adjusts the indicator’s position.

Price Type: Specifies the type of price (e.g., closing prices) used in the indicator’s calculation.

Number of StdDevs for the 1st Band: Standard deviation value for the first band.

Number of StdDevs for the 2nd Band: Standard deviation value used to calculate the second band.

Number of StdDevs for the 3rd Band: Standard deviation value for the third band’s calculation.

Reviews

There are no reviews yet.