VWAP Indicator, Unleash Accurate Trade Levels

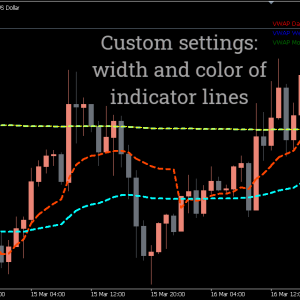

Utilizing the New VWAP indicator for MT5, you may determine the volume of the market by comparing three distinct lines.

- Description

- Reviews (0)

- Indicator Settings

Description

Based on weighted volume, the Volume Weighted Average Price, or VWAP, indicator displays the average price of a currency pair. The volume-weighted average price is known as the VWAP.

Three lines, one for each of the daily, weekly, and monthly periods, make up the indicator. These lines identify the total volume of the market and divide it according to its weight.

The VWAP indicator resembles Bollinger Bands or Moving Averages. Moving averages and VWAPs differ in that VWAP places greater emphasis on weighted volume.

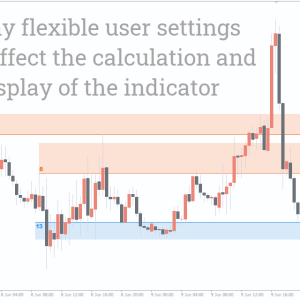

It determines the weighted volume’s average price. You can determine entrance and exit locations by using this weighted volume detection to determine levels of support and resistance.

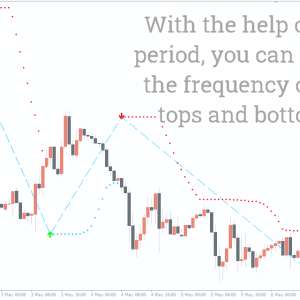

When the weekly and monthly lines cross, the indicator sends out signals, creating both long-term and short-term chances. To avoid false signals, it is better to utilize the indicator on an hourly chart, even if it performs well on all timeframes.

How to trade with the VWAP indicator?

The weighted volume through average price is shown by the VWAP indicator. This computation aids in determining the resistance and support levels. You can use these levels to determine whether to enter or exit a transaction.

When the weekly and monthly lines cross over, the indicator generates signals. For example, the monthly line is green, whereas the weekly line is red.

A bullish indication is given when the weekly line crosses above the monthly line. However, when the weekly line falls below the monthly line, it is a bearish indicator.

You can use the daily yellow line for both bullish and bearish trends because it functions as a neutral line. The trend’s direction is followed by this line. The yellow line climbs higher whenever there is an uptrend. On the other hand, it moves lower during a downtrend.

Buy configuration for VWAP indicators

- Above the green line, the blue line must cross.

- Hold off until the price has finished moving.

- At the crossing or after it, enter the trade.

- Place a stop-loss close to a buying point’s low.

- When the trend shifts, get out of the transaction.

Sell configuration for VWAP indicators

- The green line must be crossed by the blue line.

- Hold off until the price has finished moving.

- At the crossing or after it, enter the trade.

- Place a stop-loss close to a selling point’s high.

- When the trend shifts, get out of the transaction.

Conclusion

By concentrating on the weighted volume, the VWAP indicator for MT5 gives you precise entry and exit locations. You can combine the indicator with other technical analysis tools, such as the RSI or stochastics, to further validate the indications.

Be the first to review “VWAP Indicator, Unleash Accurate Trade Levels” Cancel reply

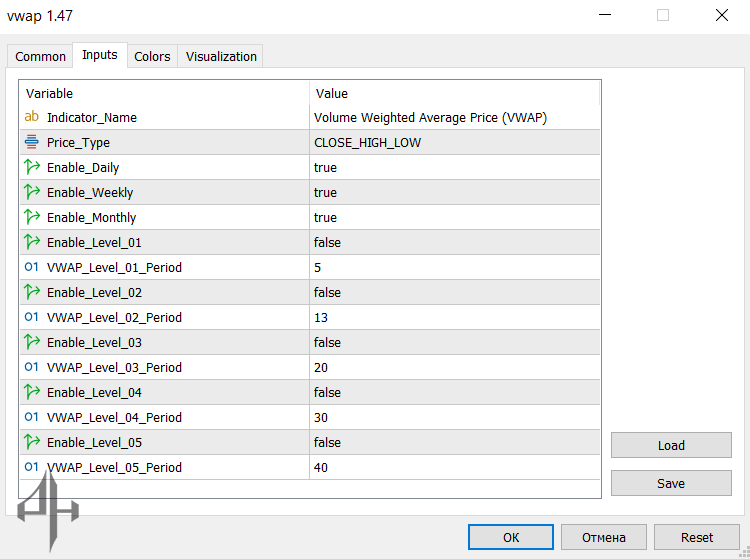

Indicator Name: Volume Weighted Average Price (VWAP)

Price Type: Defines the type of price used for VWAP calculation (e.g., close, typical, weighted).

Enable Daily: Activates the VWAP line for the daily timeframe.

Enable Weekly: Activates the VWAP line for the weekly timeframe.

Enable Monthly: Activates the VWAP line for the monthly timeframe.

Enable Level 01: Turns on the custom VWAP Level 01.

VWAP Level 01 Period: Sets the calculation period for Level 01.

Enable Level 02: Turns on the custom VWAP Level 02.

VWAP Level 02 Period: Sets the calculation period for Level 02.

Enable Level 03: Turns on the custom VWAP Level 03.

VWAP Level 03 Period: Sets the calculation period for Level 03.

Enable Level 04: Turns on the custom VWAP Level 04.

VWAP Level 04 Period: Sets the calculation period for Level 04.

Enable Level 05: Turns on the custom VWAP Level 05.

VWAP Level 05 Period: Sets the calculation period for Level 05.

Reviews

There are no reviews yet.